FlexPoint vs. Traditional Payment Methods: A Comparative Analysis for MSPs

According to data published in EMARKETER, the total value of check and cash payments for B2B transactions has fallen from 55.7% in 2019 to 32.1% in 2024.

This statistic is just one of many indicating the significant shifts in B2B payment processes.

Traditional payment methods (checks and cash) are increasingly being phased out in favor of modern alternatives, including ACH payments and credit cards.

This shift presents both challenges and opportunities for a managed service provider (MSP).

The nature of the MSP business model, which provides continuous, recurring services, demands a consistent, efficient, and scalable payment solution.

In addition to slowing down operational processes, outdated payment strategies add risk and inefficiencies.

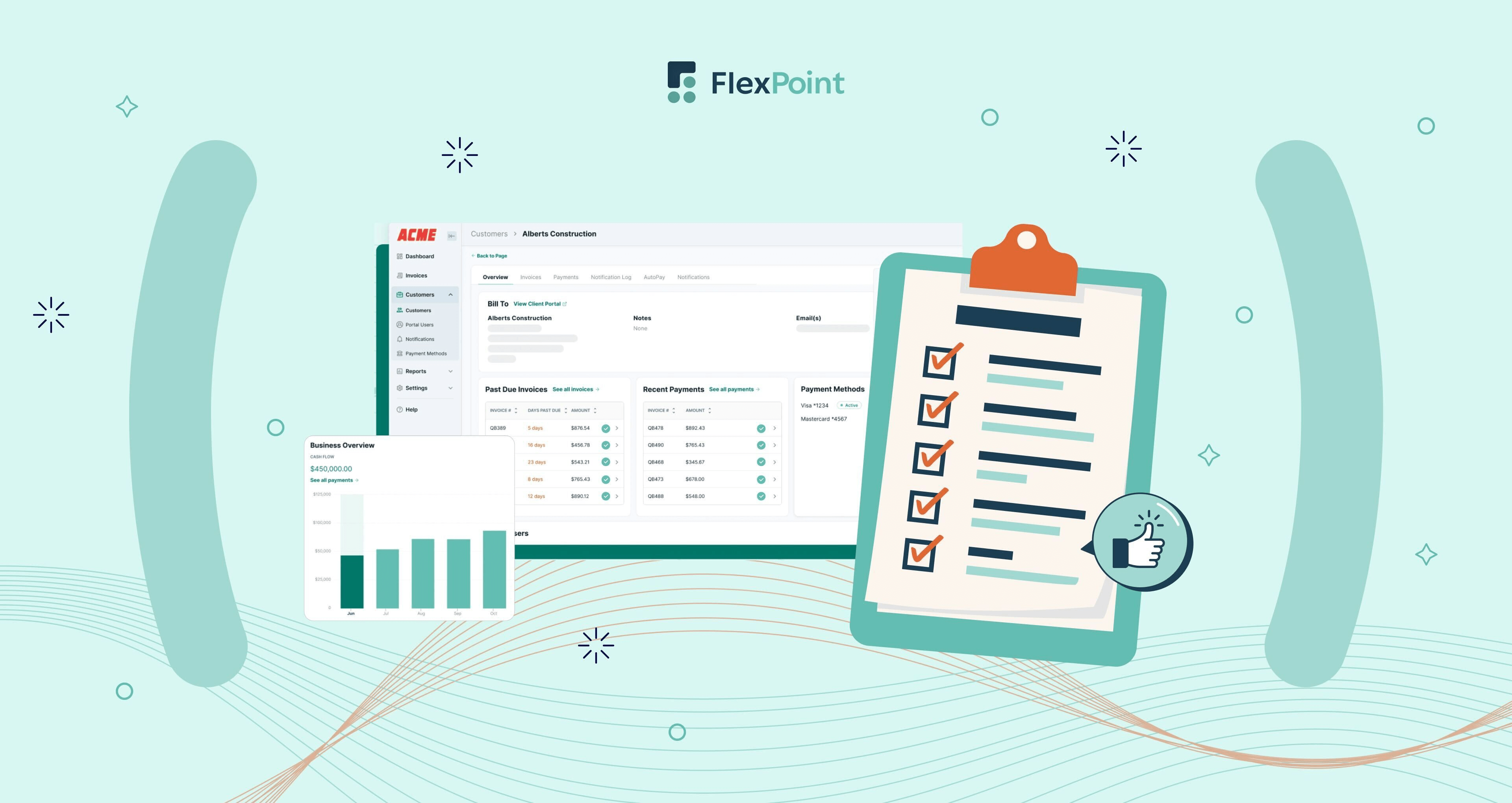

FlexPoint is a modern payment processing solution built specifically for MSPs. It addresses all of these issues.

This article examines how FlexPoint's MSP-specific payment automation software compares to other payment methods and how it directly benefits any MSP's financial health and operational efficiency.

{{toc}}

Comparative Analysis: FlexPoint vs. Traditional Payment Systems

According to a TreviPay survey, The Data is In: B2B Buyers Expect a Better Payments Experience, 72% of B2B buyers are more loyal to a business that offers their preferred payment method.

Recent data demonstrates that the use of traditional payment methods (cash and check) is quickly declining.

According to an EMARKETER report, in 2019, check and cash payments had a majority share (50%) of B2B transaction value. In 2024, it has fallen to 32.1%.

Modern payment methods are following a different trajectory.

In 2019, ACH payments made up 32.2% of B2B transaction value. Five years later, this value has grown to 47.9%.

If you stick to traditional payment methods, this will not meet modern payment expectations (ACH payments and credit cards). Then, you cannot offer most clients their preferred payment method.

Here is how modern payment solutions like FlexPoint compare to traditional payment methods.

1. FlexPoint vs. Checks

For many MSPs, checks are a slower, more labor-intensive payment.

Every step, from cutting the check to mailing it to waiting for it to clear, adds to payment delays.

These delays disrupt cash flow and create administrative hassles.

Writing and mailing checks also require the physical touch of a human. This increases the chances of mistakes, lost payments, and additional time spent reconciling accounts.

By contrast, FlexPoint’s digital-first approach eliminates the need for paper payments.

Funds are quickly processed, and automated tracking and reconciliation tools help ensure accuracy. Faster access to funds allows MSPs to manage their cash flow better.

For example, MSPs can send automated payment reminders with FlexPoint. This dramatically minimizes the lengthy manual processes for reconciling paper checks.

2. FlexPoint vs. Payment Gateways (e.g., PayPal, Stripe)

Payment gateways such as PayPal or Stripe are helpful in many industries but are not built specifically for the MSP’s billing structure.

Recurring services are standard in the MSP space. Utilizing a traditional payment gateway could increase transaction fees, integration challenges, or inflexibility.

FlexPoint, by contrast, is designed around the MSP business model.

For example, MSPs might have several service tiers, client-specific invoicing, and a variety of client payment schedules to accommodate.

Instead of relying on a generic payment portal – which may need to handle hundreds of thousands of different products – an MSP-specific solution such as FlexPoint reduces the complexity of these billing constructs.

It does this by enabling flexible invoicing and automated client payment schedules per client.

This means that regardless of how the client’s needs are structured—whether it’s a monthly plan for IT support services or a billing arrangement for project-based work—FlexPoint ensures that the correct invoices are sent.

Payments are processed automatically based on the client’s unique arrangement.

This reduces the amount of administrative overhead and improves the predictability of cash flow.

FlexPoint delivers comprehensive accounts receivable management, something Stripe and PayPal do not. This results in lower transaction fees and more extensive financial management capabilities.

For a detailed comparison of how FlexPoint compares to other payment gateways, check out these articles:

3. FlexPoint vs. Accounting Software (e.g., QuickBooks and Xero)

While accounting software such as QuickBooks Desktop/Quickbooks Online and Xero offer crucial financial management tools, they are not necessarily the best for MSPs.

FlexPoint’s direct integration with these tools allows MSPs to sync financial data in real time and see financial activity without manually entering data.

For example, FlexPoint can show all payments, invoices, and deposits as they occur so MSPs can have accurate, immediately available financial information.

Consider ten crucial features for MSPs and how FlexPoint compares to QuickBooks and Xero:

For a detailed comparison of how FlexPoint compares to accounting software, check out these articles:

4. FlexPoint vs. Other MSP Payment Software (e.g., ConnectBooster, Alternative Payments)

FlexPoint is unique in its integrations for MSP-specific payment solutions (Connectwise) and promises to simplify the payment process.

Looking closely at FlexPoint’s automated reconciliation, we see why this is an integral feature for MSPs. It reduces the tedious tasks of matching payments across multiple platforms by automatically matching invoices and payments.

This reduces the chance of error while ensuring payment processes scale up as a business grows without additional administrative intervention.

Data from the Association of Certified Fraud Examiners reports that businesses lose an average of 5% of annual revenue to fraud, and irregularities in financial records can be attributed to many fraudulent incidents.

Irregularities and errors can be spotted faster and more accurately with FlexPoint’s automated payment reconciliation. Then, you can address these issues promptly before they cost you more revenue.

FlexPoint also offers more customization features than other MSP payment software.

For example, if we compare ConnectBooster, WisePay, and Alternative Payments to FlexPoint, it’s clear why FlexPoint is the standout option for MSPs:

For a detailed comparison of how FlexPoint compares to other payment software, check out these articles:

For example, FlexPoint improves MSP-client interactions with fully customizable billing and communication tools. Customization reinforces brand identity and fosters client trust.

ConnectBooster's features lack the same level of customization, which often leads to impersonal, less engaging client interactions.

Other standout features of FlexPoint compared to other MSP payment software include:

- Same-Day ACH

- Dual-sync capabilities

- Seamless PSA and financial integration

- Long-term financial flexibility

- Customizable client interactions

- Flexible pricing

{{ebook-cta}}

7 Key Benefits of FlexPoint for Managed Service Providers

When FlexPoint is compared to several traditional payment systems, many of the advantages of using MSP-specific payment software are evident.

Next, we will cover more of the benefits of FlexPoint, specifically those related to MSPs.

1. Enhanced Efficiency

If invoices are created using PSA software like ConnectWise or an accounting tool with QuickBooks, FlexPoint ensures two-way sync so data is automatically updated across both platforms.

This eliminates the need for manual payment reconciliation between tools.

Real-time tracking makes sure you know where your money is and when you’ll get paid by tracking every invoice, payment, and deposit.

If you don’t use other tools to create invoices, you can also use FlexPoint for this.

If the invoices are already created using the PSA (Connectwise), FlexPoint’s integration ensures that the financial data is adequately reconciled and matches in all systems — PSA, accounting software, and FlexPoint.

FlexPoint can automatically generate invoices based on when services were completed or according to a pre-set billing cycle. This can be especially useful for MSPs that manage multiple clients, each with its own set of service agreements and billing parameters.

For example, if you offer many services — from support services to cloud management — completing a service can trigger automatic billing through FlexPoint’s AutoPay feature to ensure you get paid on time without manual intervention.

With the ability to create custom rules, you can automatically charge invoices based on criteria you set.

This level of automation also ensures you’re aware of billable activities, increasing revenue capture and avoiding missed payments.

Many MSPs spend significant time chasing down overdue payments from clients. Fortunately, FlexPoint also automates payment reminders.

The ‘B2B Payments Innovation Readiness’ report from PYMNTS and American Express found that businesses relying on manual processes take 30% longer to follow up on late payments than automated ones.

FlexPoint’s reminders are automatic. They are much faster than manual processes, which can speed up payment cycles and improve cash flow.

When TAZ Networks, an MSP that serves small to medium-sized businesses in Metro Detroit — started working with FlexPoint, these automated invoice reminders had a profound impact.

Each month, TAZ Networks was spending more and more time chasing late payments and resending invoices to clients.

Along with TAZ Networks accumulating a significant past-due statement, clients had no payment portal to view their invoices. This meant emails were constantly coming in looking for help.

After switching to FlexPoint, TAZ Networks clients can access a payment portal. This branded portal, which uses passwordless authentication, allows them to easily access their invoices.

Working with FlexPoint has significantly decreased TAZ Networks’ backlog.

Previously, past-due invoices averaged six to eight months overdue.

Now, invoicing time has decreased by 30%, and TAZ Networks has seen a four-fold reduction in AR aging.

2. Lower Costs

FlexPoint’s automated billing solution is geared toward managed services businesses and offers lower transaction fees from options such as ACH payments.

Transaction fees for ACH payments are generally lower than credit card transaction fees.

Credit card transaction fees typically cost 1 to 4% of the transaction amount for major networks, including Visa, Mastercard, and American Express.

ACH processing fees are structured as a flat fee or a percentage, depending on who processes the transaction.

According to a survey by the payment platform GoCardless, flat fees for ACH payments fell between $0.20 ‒ $1.50 per transaction and a percentage between 0.5 ‒ 1.5%.

In either case, it is lower than credit card transaction fees.

AFP’s Payments Cost Survey estimates the median cost per ACH transaction is between $0.26 and $0.50, making it a more budget-friendly option for MSPs.

Excellent Networks, a Texas-based MSP, is a great example of the actual cost savings from using FlexPoint’s payment automation software.

After making this switch, Excellent Networks clients quickly adopted AutoPay and ACH payment capabilities.

Not only did payments become 80% faster, but this also saved the MSP over $10,000 per year in credit card processing fees.

3. Seamless Integration

FlexPoint also integrates directly with MSP-specific tools such as ConnectWise and SuperOps.

In turn, you don’t have to use more than one billing system. This helps you avoid costly errors and provides a more familiar user interface.

For example, MSPs can map client accounts directly into their billing systems via FlexPoint’s token authentication. This means the system automatically schedules and renews payments without manual intervention.

If FlexPoint does not offer the integrations you’re looking for, it also allows you to build your own custom integrations with a powerful Application Programming Interface (API).

SkyCamp Technologies, an Ohio-based MSP that services businesses with up to 75 users, was struggling to manage multiple payment processing platforms for all its payment needs.

This lack of integration meant SkyCamp had to process every ACH payment manually.

Ready for a change, SkyCamp turned to FlexPoint and its powerful integrations that seamlessly fit into business workflows.

These seamless integrations led to impressive results for SkyCamp:

- 8 hours saved per month

- 20% increase in AutoPay use

- 30% faster payments from late clients

4. Improved Security & Compliance

Security is especially important when dealing with sensitive financial data, and MSPs need strict controls.

FlexPoint tokenizes and encrypts transaction data so client information remains secure and compliant.

Tokenization replaces sensitive data, such as credit card numbers, with a replacement value. This step makes accessing the original information incredibly difficult for a hacker.

FlexPoint also processes secure payment transactions without passing the PCI-DSS compliance burden to MSPs. Ultimately, PCI compliance is considerably simplified for our clients.

SAQ-A is a self-assessment that reduces the complexity of PCI compliance from hundreds of pages of documentation and audit preparation to just six pages of requirements.

To qualify, these businesses cannot store, process, or transmit cardholder data electronically.

Instead, eligible businesses must outsource all cardholder data processing to PCI DSS-compliant third-party providers, such as FlexPoint.

Businesses benefit from the simplified self-assessment and avoid full-scale audits and vulnerability scans.

5. Flexible Payment Options

According to data from a TreviPay study, 81% of B2B buyers say choosing their invoicing schedule is very or extremely important.

Additionally, FlexPoint’s AutoPay features allow you to offer clients this ability, and with it comes many other benefits.

Clients often appreciate automated payments, which reduce friction in the process and prevent them from paying late or forgetting about an invoice.

For instance, a client purchasing managed IT services can set up AutoPay through FlexPoint. Then, their firm’s monthly fees are deducted automatically from their accounts.

Data from a study published by Balance shows that 73% of buyers would abandon a purchase due to payment friction during the checkout process.

MSPs can also use FlexPoint’s working capital solutions to offer flexible financing options to clients.

FlexPoint’s one-click financing speeds up the sales process and removes friction for the MSP’s clients by offering them fast access to the funds they need.

This enhanced buying power means clients are likely to spend more, allowing them to purchase more comprehensive solutions. It also decreases the likelihood of delayed payments that could impact your cash flow.

Loud & Clear, an Indiana-based MSP, was hampered by limited cash flow, which prevented it from working with more enterprise-level clients.

With FlexPoint’s working capital solutions, Loud & Clear had greater access to capital, which enabled it to offer clients more flexible payment terms.

Loud & Clear generated $500,000 in new revenue through working capital, effectively reducing the gap between the MSP’s business growth and its cash flow.

As evidence of this change, Loud & Clear saw the following results:

- 400% revenue growth

- 5x faster payment processing

- Saving thousands in fees and interest

6. Real-Time Reporting

FlexPoint provides real-time reporting functionality and makes vital financial information immediately available to MSPs, including:

- Receipts

- Invoices

- Cash flow ratios

When all payments are updated in real-time, MSPs have an instant, accurate view of all payment information as a transaction is processed on their payment dashboard.

This is particularly helpful for MSPs managing a high volume of transactions or under cash-flow pressure.

On your payment dashboard, you can also review key performance indicators (KPIs) without waiting until reports are provided at the end of the day or the end of the week.

These KPIs include:

- Accounts receivable

- Incoming payments

- Cash flow

This level of detail supports more informed decision-making, whether changing payment terms for some customers, planning for growth, or promptly dealing with cash flow issues.

7. Scalability

The more successful an MSP becomes, the more operational complexity is involved in their business.

For MSP clients thinking about adding more clients, expanding the types of services they offer, or opening new territories or verticals, FlexPoint’s automated systems help billing and payment processes scale along with your business.

Using a platform like FlexPoint, the MSP doesn’t need more people to manage the growth. The platform can increase the volume handled through the system to support growth.

FlexPoint can continue to generate invoices, process payments, reconcile accounts, and so on, regardless of how big your MSP grows.

Circuit Saviors, a California-based MSP, switched to FlexPoint and saw firsthand how an MSP-specific payment platform can help MSPs scale.

Circuit Saviors smoothed out recurring billing and made it simple for clients to save their payment information, which improved cash flow.

As Circuit Saviors grew their client base and offered new services, their payment and invoicing systems kept pace without additional hands-on oversight.

FlexPoint’s automation allowed Circuit Saviors to save more than 16 monthly hours and increase cash flow by nearly 30%.

8. Customizable Solutions and Client Satisfaction

FlexPoint offers a number of features to reduce payment friction and boost client satisfaction. This includes a convenient and easy-to-use branded client payment portal (where clients can view their invoices, pay, and set up AutoPay).

The portal also employs passwordless authentication with no mandatory password, so there’s nothing for your clients to remember.

Net-Tech Consulting is a Texas-based MSP that turned to FlexPoint to save time on invoicing and improve its overall payment process.

FlexPoint’s branded payment portal eliminated many of the invoicing challenges Net-Tech was experiencing and eliminated payment friction.

The client portal allows Net-Tech clients to choose their preferred payment method, including AutoPay and ACH bank transfers.

Clients were quick to take advantage of this customized and streamlined payment experience.

This had immediate benefits for Net-Tech, including:

- 80% faster invoicing

- 20-day faster payments

- Thousands saved in ACH fees

One particular Net-Tech client was three months behind on payments. Once onboarded to FlexPoint, this client paid all three overdue invoices simultaneously.

FlexPoint also includes customizable notifications, so an MSP with its own email domain can use it to send communications.

This level of customization helps the MSP look more professional and integrates the payment experience into its overall branding strategy.

9. Automated Reconciliation

FlexPoint’s automation helps MSPs significantly cut down on errors and the time it takes to process invoices.

A 2023 study by the business research firm Ardent Partners reported that manual invoice processing can take up to 80% longer than automated invoicing.

Data from the Institute of Finance & Management (IOFM) also reports it costs an average of $16 to process a manual invoice compared to $3 for an automated one.

An MSP with a legacy, manual workflow might spend multiple hours every week simply checking that payments have gone through and been properly applied to client accounts.

With FlexPoint, payment reconciliation happens without the need for manual intervention.

Instead of getting slowed down by payment issues, MSPs can redirect that attention to providing better client services.

For example, FlexPoint client Compunet Technologies drastically reduced its monthly billing processes. What used to take half a day now takes Compunet’s accounting admin just 15 minutes a month.

Along with a 95% reduction in time spent on invoicing, Compunet’s billing cycles are also four times faster.

Conclusion: Why FlexPoint is the Superior Choice for MSPs

FlexPoint provides MSPs with a payment solution designed to meet their unique operational needs.

FlexPoint automates key processes such as billing, invoicing, and reconciliation. This effectively reduces human error and administrative burden and optimizes cash flow.

With an MSP-centric approach to payments, FlexPoint also helps MSPs become more efficient while providing a smoother billing experience for their clients.

FlexPoint offers MSPs access to up-to-date reporting and secure, PCI-compliant payment processing.

Additionally, cost-effective ACH payment options help MSPs save money on transaction fees and redirect that capital into expanding their businesses.

Choose FlexPoint as your go-to MSP payment processing solution to stay competitive and responsive to MSP market demands.

Transform your MSP payment processing with FlexPoint. Discover how our modern solutions outperform traditional methods in efficiency and cost-effectiveness.

Visit our website or contact us to learn more and schedule a demo today.

Additional FAQs: FlexPoint for MSP Payments

{{faq-section}}

.avif)