MSP Payment Challenges: Common Issues and How to Overcome Them

Research from MSP Insights revealed that 81% of managed services providers aren’t paid on time. On average, it takes 60 days to receive a late payment.

According to research from the U.S. Bank, 82% of small business failures are due to poor cash flow management; it makes sense that 72% of MSP owners regularly worry about cash flow.

Navigating through these payment and cash flow challenges can mean the difference between MSPs thriving or struggling. Before working through these challenges, you must understand precisely what your business is up against.

This article will discuss the biggest MSP payment challenges and provide a detailed exploration of how to overcome them.

You will also learn about strategic payment solutions to boost your MSP operational efficiency and client satisfaction.

{{toc}}

10 Common MSP Payment Challenges

Financial management, particularly around payments, is a critical area that can significantly impact an MSP’s overall business health.

As the examples below show, addressing payment-related challenges can help your business improve cash flow, build client relationships, and sustain growth.

Here is a list of 10 of the most common MSP challenges relating to payments and how they affect your business.

1. High Transaction Fees

The average MSP profit margin is 8%; best-in-class MSPs have an average margin of 18%.

This 10% difference is substantial, and high transaction fees can prevent you from achieving those higher margins.

MSPs incur significant payment collection costs for credit card payment processing. As high transaction fees accumulate, margins shrink, making it difficult for MSPs to remain profitable.

Often, the financial burden imposed by these fees can hinder an MSP’s ability to reinvest in expansion opportunities or service enhancements.

For example, some MSPs pay credit card processing fees on behalf of their clients. These fees are usually between 1.5% and 4% of the total transaction value.

An MSP that processes $100,000 in monthly transactions can pay transaction fees that total up to $3500 per month or $42,000 per year.

Imagine the difference an extra $42,000 could make to your business in a year. Understandably, high transaction fees are a pressing MSP payment challenge many companies want to overcome.

2. Security Concerns

In a study from Kaseya, 78% of MSPs reported cybersecurity as a prominent challenge.

A single cyberattack on one MSP could result in $80 billion in damages across hundreds of businesses.

In addition to the profound financial implications of these breaches, an MSP can expect serious reputational harm and other consequences.

MSPs must constantly update security measures and comply with industry standards to safeguard their payment systems against cyber threats. Failure to do so can result in costly data breaches and eroding client relationships.

3. Limited Payment Options

In 2022, Balance Payments, Inc. surveyed more than 400 B2B buyers. Approximately 83% of respondents said a smooth payment and checkout experience was their top priority.

B2B buyers also reported that not having their preferred payment method at checkout is the number one reason they would switch to another company.

When an MSP offers numerous payment methods (credit cards, debit cards, ACH transfer, flexible financing, wire transfers, etc.), it can access a more extensive client base. Otherwise, it is limited to clients who only use its specific payment methods.

Offering minimal payment options can also frustrate your existing clients or cause you to lose them altogether. It can also delay payments (and restrict cash flow) until a client can pay with an accepted method.

4.Inaccurate Reconciliation

Manual processes, including manual payment reconciliation, are prone to error.

When MSPs rely on manual reconciliation, they encounter discrepancies in financial data, resulting in inaccurate financial records and statements.

These inaccuracies can lead to client disputes, which cost MSPs in terms of administrative work and the costs of settling them. Client disputes also damage an MSP’s credibility and strain client relationships.

Implementing automated reconciliation software can help MSPs address these payment issues. Automated systems ensure accurate transaction matching, meaning each payment correctly aligns with its corresponding invoice.

This leads to more reliable financial records, fewer client disputes, and a more efficient payment process overall.

5. Delayed Payments

We have discussed how most MSPs are not paid on time and how nearly 75% of MSP owners worry about cash flow.

Your business cannot offer consistent and reliable services without adequate cash flow. A lack of adequate cash flow compromises your ability to cover operational expenses.

Delays in paying staff, vendors, and other critical resources follow, resulting in decreased service quality and client satisfaction.

Like high transaction fees, limited cash flow makes it more challenging to invest in scaling your business and to pay operational expenses in full and on time.

Whether you were planning to use those funds for upgrading technology, growing your team, or expanding your marketing efforts, a lack of funds restricts your ability to scale.

6. Complex Billing Cycles

When an MSP isn’t equipped to handle complex billing cycles, including automated payments, its payment process will likely be inefficient and time-consuming.

MSPs typically have complex billing cycles. Many manage multiple services, each with different rates and billing frequencies, which creates a challenging manual payment processing environment.

Without suitable systems in place, MSPs may struggle with tracking invoices, invoice accuracy, and getting paid on time.

For example, MSPs commonly offer subscription-based services or usage-based models with more complex billing cycles than straightforward transactions.

This complexity is due to both payment models involving more data to accurately track service usage, prorated billing, and adjustments for any changes in the service level during the billing period.

Increased administrative work slows down MSP operations when a payment system can’t support complex processes like auto payments.

It can also lead to billing errors due to the complexity of the transactions and delayed payments as these errors are addressed.

7. Regulatory Compliance

Complying with regulations, such as PCI DSS, is critical for MSPs to avoid legal repercussions. These regulations also help protect business and client data.

PCI compliance means complying with security standards set by the Payment Card Industry Security Standards Council (PCI DSS). These standards apply to businesses that process, store, or transmit cardholder data.

However, the level of compliance required varies depending on the volume of card transactions your MSP processes each year.

PCI DSS Compliance Levels:

- Level 1: For large businesses that process six million or more transactions per year

- Level 2: For businesses that process between one million and six million transactions per year

- Level 3: For businesses that process between 20,000 and one million transactions per year

- Level 4: For businesses that process 20,000 transactions per year or less

A PCI Level 1 business is subject to stricter standards for compliance. Levels 2-4 must complete a Self-Assessment Questionnaire (SAQ). There are nine SAQ versions. The right type for your business depends on how you process credit cards.

For example, card-not-present merchants that fully outsource all cardholder data functions would complete Questionnaire A.

“Merchants with Standalone, IP-Connected PTS Point-of-Interaction (POI) Terminals – No Electronic Cardholder Data Storage” would use the SAQ BI-P.

The compliance requirements for level one businesses are stricter. In addition to completing the appropriate SAQ, it must also meet other requirements, including all 12 PCI requirements.

These businesses must also have a Qualified Security Assessor (QSA) or internal security assessor perform an onsite compliance audit each year. The auditor reviews the SAQ and compares it with their findings to create a compliance report.

PCI Compliance Costs

PCI compliance comes with its own costs, too.

Data published in CX Today gives examples of what you might expect to pay for annual PCI compliance costs.

- A small MSP might pay around $500 for annual Level 4 self-validated PCI compliance.

- Level 3 businesses that process between 20,000 and 1,000,000 transactions usually pay a minimum of $1,200 per year in PCI compliance costs.

- Annual compliance costs for Level 2 businesses that process between one and six million in yearly transactions tend to be $10,000 or more.

- A Level 1 business that requires a third-party onsite audit can expect to pay at least $50,000. The onsite audit alone costs between $30,000 and $40,000.

Depending on the audit results, a business may face extra remediation costs to address compliance issues. These can range from a few thousand dollars to $500,000 or more.

8. Inconsistent Cash Flow

Irregular payment timings affect an MSP’s overall financial stability.

As we saw with delayed payments, inconsistent cash flow creates challenges in managing day-to-day operations, paying employees, and investing in business growth.

This financial inconsistency makes effective financial planning and budgeting difficult, too.

Without the ability to reliably forecast your revenue and expenses, you risk delaying or canceling client projects. This limits your ability to pursue new business opportunities because you lack the funds to move forward.

9. Client Disputes and Chargebacks

Handling disputes requires robust processes to resolve issues promptly and maintain client satisfaction. Client payment disputes and chargebacks disrupt cash flow and create added administrative burdens.

The financial toll of chargebacks adds up fast for MSPs.

Let’s say your new client pays you $3,000 and uses a credit card to make the payment. They dispute this transaction three weeks later, and the payment processor removes the funds from your account.

You might have already spent this money or budgeted with it in mind, and now you are $3,000 short.

Beyond the loss of that $3,000, you incur chargeback costs, and your credit card processing fees are not returned.

Again, these credit card processing fees will likely be between 1.5% and 4% of the transaction value.

Each chargeback typically costs a merchant between $20 and $100 per transaction. In this case, your payment processing platform has a flat fee of $50 for chargebacks.

Let’s also assume that you pay 4% in credit card processing fees per transaction.

On a $3,000 payment, you paid $120 in processing fees. Even though the payment has been returned to the client, you are not reimbursed for these fees. Your total losses equal $3,120 plus a $50 chargeback fee.

This chargeback now costs your business the $3,000 in revenue you had planned for and $170 in transaction and chargeback fees.

While that is just one example of how chargeback fees and disputes pose a challenge for MSPs, it highlights their substantial impact on an MSP.

10. Technical Challenges with Payment Software

In The 2023 Global Managed Security Survey, 32% of MSPs polled listed “integrating technology solutions” as a top challenge.

When an MSP sets out to integrate new payment systems with existing tools, technical challenges (including software glitches and compatibility issues) are common.

Imagine your MSP implementing a new payment processing system to streamline billing and reconciliation.

Unfortunately, this system wasn’t vetted or compatible with your current PSA software. Now, your business is left dealing with system crashes and data synchronization errors.

Your business is left with several MSP payment challenges, including slower payment processing, frustrated clients, and more work for administrative staff.

While the list of challenges may be extensive, the solutions to these challenges are, too.

{{ebook-cta}}

10 Effective Strategies for Improving Common MSP Payment Challenges

As we mentioned, the good news about MSP payment challenges is that there are effective solutions for virtually all of them.

Here are ten strategies tailored to the specific challenges we’ve discussed above.

1. Automating Invoice Generation

Manual invoicing can drain your company’s resources, especially as your business grows and you have more company processes.

Switching from manual to automated invoicing saves MSPs time and money.

Consider Compunet Technologies, a California-based MSP, for example. When the IT services company added payment automation with FlexPoint’s AutoPay feature, this move resulted in 95% faster invoicing and a four-times faster billing cycle overall.

Compunet Technologies’ faster invoicing isn’t an outlier, either. Research from Ardent Partners found that switching to automated processes reduced the average time to process a single invoice by 81%.

Research from the Institute of Finance & Management (IOFM) also found that the average cost for processing a manual invoice is $16. For an automated invoice, this cost drops to $3.

Manual invoicing is also prone to human errors. These mistakes cost you even more time and money to resolve them.

For example, delaying your payments due to an invoicing error can restrict your cash flow until the issue is resolved.

The money and time you would save by automating payment processing can instead be redirected back into your business.

2. Using Integrated Payment Solutions

Choosing a payment solution that seamlessly integrates with your MSP management tools (PSAs) helps you avoid compatibility issues and the problems that come with it.

Before choosing a particular solution, ensure it is compatible with the existing systems you plan to use.

For example, choosing a solution that integrates with your MSP's accounting software (such as QuickBooks Online, QuickBooks Desktop, Xero)and PSA (such as ConnectWise, SuperOps) will create a much more seamless workflow.

This is another move that reduces administrative workload. Your administrative staff might spend a lot of time trying to sync data between all systems, only to find out they are incompatible.

3. Offering Multiple Payment Methods

Multiple payment methods boost client satisfaction and open your business to a far greater client base. Your business should choose a payment system built specifically for MSPs that offers all primary payment methods, including credit cards, debit payments, and ACH.

Offering more payment methods gives you access to a broader client base and improves client satisfaction rates. It also makes it easier to pay, speeding up the payment cycle by reducing any payment friction.

4. Implementing Advanced Security Measures

Utilizing solutions with robust security features like encryption and compliance with industry standards can protect against fraud. These help your MSP comply with PCI requirements and others, which we’ll discuss in a moment.

However, robust security measures offer your business-critical security protection besides compliance.

If your MSP has appropriate security measures, it will better protect clients' financial data, build trust in you, and shield your business from cybercrimes.

Advanced security measures can also pay off in terms of cost savings. If you recall, chargebacks can significantly cost your business. With security features like AVS, you can dramatically reduce fraud and chargebacks.

Other MSP security features to look for include:

- Passwordless authentication

- A secure checkout process in a branded portal

- Card account updates to keep card information current and prevent failed payments

5. Setting Clear Payment Terms

You can avoid misunderstandings, delays, and other MSP payment challenges if your payment terms are clear.

Included in these payment terms should be the following:

- Payment expectations

- Late fees

- Acceptable payment methods

- Payment due date

- Dispute resolution protocol

- Consequences of non-payment

Ensure clients understand these terms (not just sign them) to avoid disputes, delayed payments, and other issues down the road.

6. Utilizing Payment Analytics

Payment analytics can be instrumental in optimizing cash flow and avoiding the problems of inconsistent cash flow.

When you can access comprehensive payment data and analyze it to spot trends or issues before they become more significant problems, your business will save a lot of trouble.

For example, your data might tell you about specific patterns, including increasingly late payments, before you spot them yourself. Payment data can also offer insights into client behaviors and flag potential bottlenecks before they severely impact your business.

Keeping a close eye on payment data also offers you the gift of being proactive rather than reactive when cash flow becomes an issue. The sooner you can spot it, the sooner you can address it.

Suppose your MSP chooses a payment platform with powerful payment data analytics. In that case, you can make data-driven decisions to optimize its payment processes, identify and address recurring issues, and improve overall financial performance.

Regular analysis can also help MSPs anticipate cash flow needs and plan accordingly.

7. Streamlining Payment Approvals

Reducing the steps required in the payment process can speed up transactions. Simplifying the internal approval workflow can eliminate unnecessary delays and improve efficiency.

MSPs can implement automated approval systems that route invoices to the appropriate personnel for quick review and authorization.

For example, if a payment exceeds the amount on an invoice, these systems can automatically flag it and reroute it to the relevant manager for approval.

This timely payment processing accelerates the payment speed, reduces the administrative burden on staff, and enhances client satisfaction.

8. Regular Payment System Updates

Regularly updating your payment systems can mitigate MSP payment challenges like regulatory compliance, inaccurate reconciliation, and technological difficulties.

When payment software is up to date, it can minimize disruptions and system performance issues and offer better protection from security threats by addressing vulnerabilities in previous versions.

“Updating your systems” is PCI Requirement 6.

Cybercriminals can access PAN and other cardholder data if your payment systems have vulnerabilities. Sometimes, installing the latest vendor-provided security patches for your payment systems is all it takes to prevent these cybercrimes.

9. Training Staff on Payment Tools

If a staff member doesn’t have sufficient training on your payment systems, this can be a weak link that leads to mistakes and other vulnerabilities.

Comprehensive training programs can equip staff with the knowledge and skills to manage payment processes effectively.

MSPs should provide comprehensive training programs (including ongoing training sessions) to keep employees updated.

You can also ask your payment software vendor to train your entire billing and finance team. This will give your team a thorough understanding of the tools they use to navigate any issues confidently.

Well-trained staff can handle payment tasks more efficiently, reduce the likelihood of mistakes, and provide better client support.

10. Optimizing Payment Gateways

Your choice of payment gateways can also play a big part in your MSP’s financial success.

Payment gateways with lower fees and better service terms can save you money and improve reliability. Not only do payment processes become more efficient, but transaction costs are also reduced.

To evaluate different payment gateways, evaluate their:

- Fee structures

- Service reliability

- Customer service

Optimizing payment gateways can lead to significant cost savings, improved transaction speeds, and a better overall payment experience for clients.

Conclusion: Enhancing MSP Payment Operations with Strategic Solutions

This blog post addresses ten common MPS payment challenges and provides strategic insights for overcoming them.

As we’ve seen, a proactive approach to these challenges benefits operational efficiency, client relationships, and cash flow.

Key issues, including high transaction fees, cybersecurity, payment options, and inconsistent cash flow, significantly impact your profitability and reputation.

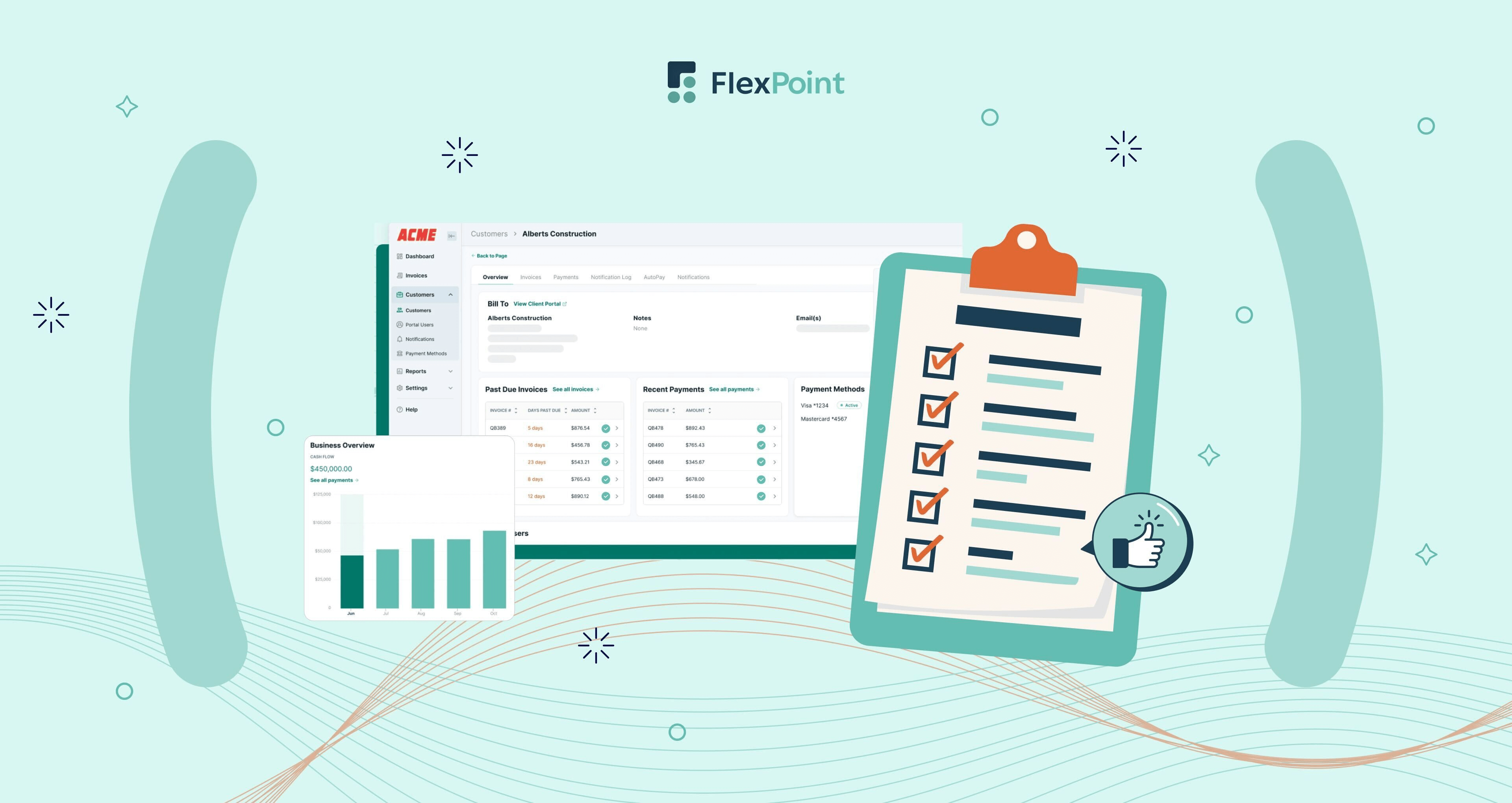

FlexPoint emerges as a comprehensive tool that complements the strategies outlined in this article. Integrating FlexPoint into your payment solutions lets you leverage MSP-specific payment platform features to drive business growth.

With it, you have the tools to overcome MSP payment challenges. This includes automated invoice generation, AutoPay, accepting multiple payment methods, advanced security measures, and powerful payment analytics.

With its unique advantages, FlexPoint can help streamline payment processes, reduce administrative burdens, and improve financial stability.

SkyCamp Technologies, an Ohio-based MSP that services businesses with up to 75 users, was facing several payment challenges and enlisted FlexPoint’s help.

Among these challenges was a lack of integration among the multiple payment processing platforms it needed to address all of its billing needs.

SkyCamp Technologies' president, Dan Illausky, explained he had to manually process each monthly ACH payment since invoice amounts changed based on customer license counts.

Upon switching to FlexPoint, SkyCamp saved eight hours of work per month. Payments from late clients also became 30% faster, and 20% more clients used AutoPay.

Behind these improvements are specialized solutions, such as end-to-end automation, a centralized billing and payments platform, and a modern interface.

Tackle your MSP payment challenges with FlexPoint. Learn how our specialized solutions can streamline payment processes and enhance operational efficiency.

For more details on how FlexPoint can specifically address your payment issues and improve client satisfaction, schedule a personalized demonstration today!

Additional FAQs: MSP Payment Challenges

{{faq-section}}

.avif)