MSP Payment Automation: Combining Efficiency with a Personalized Approach

According to The Institute of Financial Operations and Leadership (IFOL) 2024 study on accounts payable automation, manual invoice entry dropped from 85% in 2023 to 60% in 2024.

This data proves that businesses are moving away from manual payment processes toward faster and more cost-efficient automated options.

Research from Ardent Partners reports that invoice automation is up to 80% faster than manually processing invoices.

A special report from the Institute of Finance & Management (IOFM) also found that, on average, it costs five times more to process a manual invoice than to automate it.

While these cost and time benefits are impressive, they can’t come at the cost of offering a personalized approach to your clients.

Automation is not enough — clients also value personalization.

McKinsey data shows that faster-growing companies drive 40% more revenue from personalization than slower-growing businesses.

Further, LLCBuddy data found that businesses see revenue rise by 10% to 15% when they use personalized client portals.

This article will show how payment automation can reduce manual effort, minimize errors, and optimize cash flow while maintaining a high personalized client service standard.

{{toc}}

The Importance of Payment Automation for MSPs

Payment processing becomes incredibly cumbersome when an MSP processes a high volume of manual financial transactions.

For instance, when a business grows and onboards additional clients, manual invoicing, inefficient payment processing, and record-keeping become more challenging to scale.

With payment automation, an MSP can process client payments quickly and accurately.

Automated systems reduce the need for human intervention in financial processes, ensuring payments are made at the right time and amount.

Less human intervention frees up your staff to focus on other strategic initiatives, which also lowers the chances of human error.

This section will review the proven benefits of using payment automation specifically designed for MSPs.

1. Client Retention and Satisfaction:

According to data from Outbound Engine, acquiring a new client costs five times more than retaining an existing client.

Data from Invesp also reports that the probability of selling to an existing customer is 60-70% versus just 5-20% for new prospects.

Additionally, research from the Harvard Business School found that just a 5% increase in client retention can increase profits by 25-95%.

These statistics highlight the importance of prioritizing client retention.

Payment automation plays a vital role in this aspect by offering numerous payment options for clients with personalization and flexibility that suit their needs.

When clients can pay on a schedule that works for them, it inspires more trust and confidence.

Suppose an MSP provides a cybersecurity services bundle for clients with different payment terms. While some clients may prefer paying monthly, others prefer paying quarterly or annually.

A payment system could configure the billing cycles to match clients' preferences.

This will signal to the clients that their requests have been heard and that their business is valued. This benefit of timely and accurate invoicing will translate to greater client satisfaction and retention rates.

2. Error Reduction:

Data published in Online Invoices finds that 61% of invoices are paid late due to inaccuracies. According to DocuClipper data, manual data entry has a lower accuracy rate than automated data entry.

So, if you’re processing invoices manually, your likelihood of errors increases, as does your chances of receiving late payments (which is already an issue for most B2B companies).

For example, for 5,000 data entries, automated systems could make between 0.5 and 2 errors, whereas human data entry could result in 50 to 200 errors.

Payment automation effectively reduces the risk of such errors, as invoices are automatically generated, payments are made on time, and records are updated without human intervention.

Take a business process, such as sending invoices. Often, these errors come from a staff member incorrectly entering names, card details, and amounts.

The administrative headache of rectifying these problems is significant. There might be late invoices, unhappy clients, a need to re-send invoices, and an administrative burden for re-issuing credit.

Automating the process can prevent all of this.

With its higher accuracy rate, data entry automation significantly decreases the likelihood of human error in financial transactions, improving billing and payment processing accuracy.

3. Cost Efficiency:

Payment automation also helps MSPs lower their operational expenses. Automated payment systems cut operational costs while speeding up payment cycles to improve cash flow.

A report from Goldman Sachs found switching from manual to automated invoice processing can reduce processing time by 70-80%.

Another Institute of Finance & Management report revealed that companies using manual payment methods spent an average of $8.78 to process an invoice.

Automated payment systems reduced the cost to $1.77 per invoice, a nearly 80% savings.

Consider an MSP that spends $5,000 monthly on manual payment processing. They could reduce this cost by 80% with automated payment processing.

This means monthly payment processing costs would drop to $1,000, equaling a savings of $4,000 per month or $48,000 annually.

The MSP could reinvest these savings into growth projects, staff development, or client acquisition efforts.

4. Improved Cash Flow:

Data published in MSP Insights reports that 70% of MSP owners worry about cash flow.

Without adequate cash flow, you will struggle to cover operational costs, plan for the future of your MSP, and scale your business.

This is another area where switching to payment automation can be a transformative decision.

Automating payments sends invoices out on schedule, automates reminders, and speeds up payments. These steps reduce the chances of slow payments and optimize cash flow.

Manual invoices can be delayed when they rely on human intervention to be sent or if they are lost or delayed due to human error.

Automating this process means invoices are sent automatically on a predetermined schedule. Payment reminders can also be automatically sent to clients.

This allows the MSP to have a more consistent cash flow and to reinvest in the business.

5. Scalability:

To scale effectively, an MSP must increase its revenue faster than its costs. This is nearly impossible if manual payment processes slow down cash flow and staff.

With manual payment processing, you pay staff to spend time on things you could easily automate. This includes chasing late payments, reconciling accounts, and sending invoices.

Using late payments as an example, data from PYMNTS and American Express reports that businesses using manual processes take 30% longer to follow up on overdue payments than those using automated processes.

Speeding up this process also means speeding up your payment cycle, meaning your payments are completed faster. Then, you have quicker access to more cash flow.

By automating payment processes, MSPs can scale their operations proportionally without increasing their administrative resources.

6. Enhanced Security:

Automated security measures reduce the possibility of data leaks or fraud.

The 2024 AFP Payments Fraud and Control Survey Report found that 80% of organizations were victims of payment fraud attacks or attempts in 2023, a 15% increase from the previous year.

Further, 30% of companies that were victims of payment fraud attacks could not recover any of the lost funds.

According to AvidXChange, the average organization loses 5% of its revenue to fraud, and the average loss totals more than $1.78 million.

Payment automation software is a viable solution for the growing problem of payment fraud and its associated risks.

Best-in-class MSP payment automation systems offer passwordless authentication and encrypted payments and can safely store sensitive data. This protects client payment information from intrusion, enhancing their trust in the MSP and minimizing the MSP’s liability.

7. Regulatory Compliance:

Security and compliance go hand in hand, including the need for MSPs to adhere to the Payment Card Industry Data Security Standard (PCI DSS) and SAQ-A.

Businesses that store, process, or transmit credit card data must comply with these standards or risk significant penalties and reputational damage.

This set of security standards protects cardholder data from various threats, including unauthorized access, disclosure, use, modification, disruption, or destruction.

For example, the PCI SSC can impose fines of up to $500,000 per violation of the PCI Data Security Standards.

If you use PCI-compliant MSP payment automation software, you can meet critical security requirements with much less effort.

Beyond ensuring the security of clients’ sensitive customer data, compliance diminishes the risk of fines and other legal sanctions. It helps you provide clients with a high level of security without complicating the payment process.

8. Real-Time Data Access:

Payment automation systems give MSPs access to their financial data in real-time. This allows them to make crucial decisions faster based on more precise information.

This data can tell you which invoices are still outstanding, which clients will likely pay late, and when to expect payments.

Depending on the data and information you collect, you can assess late payment patterns and take action to improve cash flow. The resulting data helps you anticipate future revenue and adjust your financial strategies.

9. Integration Capabilities:

In a survey of IT decision-makers, a lack of integration technology was reported to cost businesses an average of half a million dollars annually.

Another benefit of modern payment automation software is its seamless integration with other essential business tools, such as PSA and accounting software.

Integrated systems provide a centralized point for managing contracts, tracking services, and automating payments, improving overall efficiency.

Rather than spending time syncing data between systems or manually reconciling payments, your admin staff can direct their attention to other work.

When a lack of integration means more manual work is required, the risk of errors increases, as does the time it takes to correct them and complete critical payment processes.

If these payment processes aren’t completed accurately or promptly, your MSP will struggle to manage cash flow effectively.

You risk being short on cash or misdirecting your funds, and you will make decisions based on outdated information.

{{ebook-cta}}

Balancing Automation with Personalized Client Service

Having established the benefits of MSP payment automation, we will now move on to balancing automation with personalized client service.

Personalization is a crucial driver of client satisfaction, and the importance of focusing on this cannot be understated.

Although payment automation promises increased efficiency and accuracy, MSPs must ensure it doesn’t compromise client service.

Personalization is still paramount to client relationships, and when automation happens alongside personalization, it works best, providing a consistent and personalized experience.

Here are eight strategies to personalize your client service while simultaneously automating payments.

1. Personalized Communication

Automation does not mean forgoing personalized communication.

Your automated payment system can send clients thank-you notes, overdue payment reminders, and AutoPay reminders.

For instance, a tailored thank-you email sent after a payment comes through (‘Thanks, X, for paying this invoice. Details of your account are below’) or personalized payment reminders can all be generated based on past interactions with the client.

With FlexPoint, for example, you can use your own email domain. This way, clients receive payment reminders and other notifications directly from your business.

The major takeaway is that, as you automate, clients can still feel like they’re getting personalized attention, even if your business is reaping the benefits of increased scale and consistency.

2. Client Portal Access

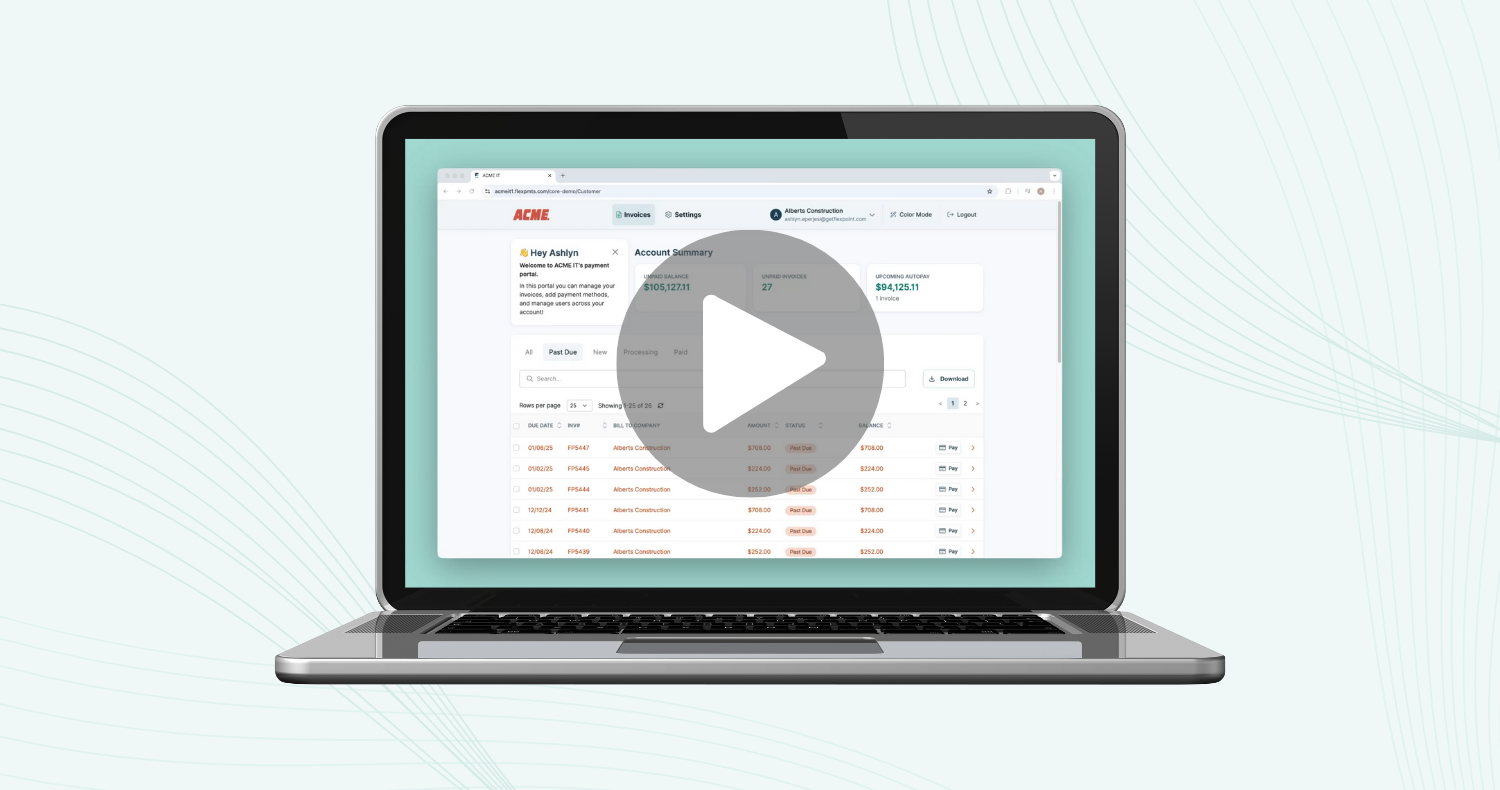

An automated system with a self-service payment portal lets clients access their payment history, current invoices, and payment options. The portal is always up-to-date with real-time information from the system.

Clients can log into a secure portal to see if a payment has been made, view past invoices, or change their billing information. This level of transparency and ease builds trust and minimizes back-and-forth communication.

With FlexPoint, you can tell when clients have last viewed and clicked their invoices. Payment portals are also branded with your business information, reinforcing your brand identity.

3. Customized Payment Options

MSPs can offer clients various payment options, including ACH transfers, credit card payments, and flexible financing, while still taking advantage of automation's efficiencies.

This can reduce payment friction and boost client satisfaction. According to data from a CapChase survey of 500 US-based B2B leaders, 81.2% say that an inability to offer flexible payment options prevents deals from closing.

Along with providing numerous payment methods, offering a flexible payment schedule can also help you close sales.

If prospective clients are worried that rigid payment terms will inhibit cash flow, offering them a flexible payment schedule can encourage them to sign up.

The data from CapChase reports that negotiating payment terms increases the sales cycle by 16.2 days. If you provide clients with options for payment terms that work for them, you can dramatically shorten the sales cycle.

4. Proactive Service Alerts

Automation allows the MSP to send clients proactive service alerts regarding upcoming billings, service renewals, or special deals that may interest them.

For example, you might send an alert to a client a month before their one-year subscription period is about to expire, offering the client a discount for renewing before that time frame expires.

An automated alert like this could increase renewals and client retention.

If the client does not intend to renew their service or does not realize renewal is coming up, this notice also gives them time to cancel before you charge them.

Otherwise, the client could call their card-issuing bank, dispute a charge, and claim they did not know they would be charged again or did not plan to renew. This is known as a chargeback, which can be incredibly costly for MSPs.

5. Transparency Reporting

Through automation systems, MSPs can generate detailed, customized reports on payment activity, allowing clients to see the history and balance of their billing.

This helps build trust and provides transparency that keeps clients informed.

For example, you might produce a customized quarterly report each client can review. The report will detail all the services provided through the quarter, their payment, and when they will receive their next invoice.

Providing the client with this documentation helps enforce the value your services deliver.

Conclusion: Streamlining Payments Automation with FlexPoint

Payment automation is essential for MSPs to manage financial processes efficiently.

Modern technology enables businesses to automate the entire payment process, from invoice generation to collection and record-keeping.

Sophisticated automation platforms also offer customized billing and secure payment processing, allowing MSPs to manage cash flow more effectively while providing a tailored service experience for clients.

The beauty of payment automation is that it doesn’t come at the cost of personalization. You can enjoy the operational efficiency automation brings without sacrificing client satisfaction.

Automation removes the burden of tasks like invoicing, payment collection, and financial reporting, enabling MSPs to focus on delivering value.

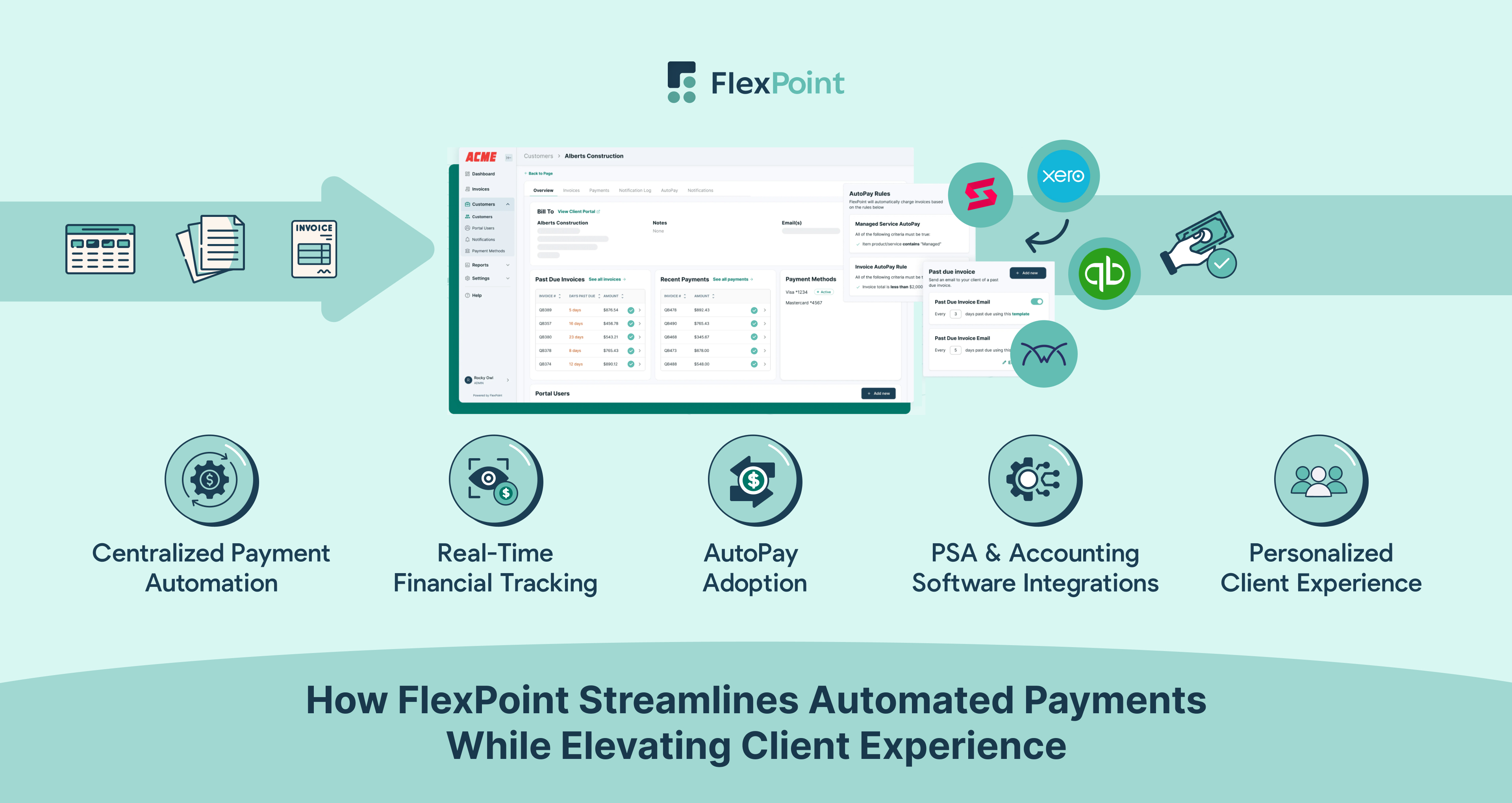

FlexPoint helps MSPs achieve these goals with a comprehensive payment automation solution that integrates seamlessly with existing systems and is fully customizable to meet each client's unique needs.

In addition, by integrating payment automation with other business tools, MSPs can gain a comprehensive view of their operations while saving time and reducing labor costs.

With FlexPoint, you can integrate your PSA (ConnectWise, SuperOps) and accounting software (QuickBooks Desktop, Quickbooks Online, Xero) to create a streamlined ecosystem that seamlessly connects client services, invoices, and payments.

This ensures that MSPs can enhance operational efficiency while maintaining a personalized service experience.

SkyCamp, an Ohio-based MSP, turned to FlexPoint for a centralized, modern billing solution for payment automation.

Its previous platform lacked integration capabilities, so SkyCamp was left manually processing ACH payments each month.

Among the many changes it saw after switching to FlexPoint, SkyCamp saved eight hours per month on payment-related tasks.

SkyCamp also saw a 20% increase in AutoPay use; late clients paid 30% faster.

Each of these changes “translates to more money in our pockets,” says SkyCamp president, Dan Illausky.

Like SkyCamp, you can reduce operational burdens, improve efficiency, and provide your clients with a higher quality of service.

With real-time financial tracking, automated receipts, notifications, and security features, FlexPoint is the ultimate platform for MSPs.

Transform your MSP payment processes with FlexPoint. Embrace automation to enhance efficiency and personalize your client interactions.

Visit our website or contact us today to learn how FlexPoint can streamline your payment operations and help you focus on what matters most—your clients.

Additional FAQs: Implementing Payment Automation in MSPs

{{faq-section}}

.avif)