Mastering MSP Payments Audit: A Comprehensive Guide to Streamlining Your Financial Checks

Research from PYMNTS revealed that 80% of B2B leaders report losing business to payment errors. Further, more than half of these leaders report that it has happened more than once.

Payment errors and miscommunications – including discrepancies in financial data – result in inaccurate financial records and statements.

Money lost to these mistakes is a form of revenue leakage — money an MSP earns but does not collect.

Unfortunately, this problem can be even worse for subscription-based businesses, which applies to many managed service providers.

If your recurring billing process contains errors, these mistakes can compound on a fixed schedule, leading to revenue leakage.

According to World Commerce & Contracting information, some businesses lose up to 9% of their revenue to leakage. Additionally, 42% of companies experience revenue loss.

The good news is that many of these sources of revenue leakage could be found with additional oversight of billing and payment processes, including conducting payment audits.

This is good news because many causes of revenue leakage, including recurring billing errors, are easy to fix. The problem is that they can't be fixed until these issues are first identified.

Fortunately, a payments audit can spot and address revenue leakage issues that impact your cash flow and the success of your MSP.

This article will discuss the importance of conducting payments audits for MSPs, the step-by-step process of conducting an audit, and best practices for auditing your payment system.

{{toc}}

7 Benefits of Payments Audits for MSPs

Payments audits are an indispensable strategy that addresses the accuracy, reliability, and efficiency of MSP financial operations.

This section will discuss the consequences of payment inefficiencies and errors an MSP could experience, which helps demonstrate the importance of conducting payment audits.

1. Risk Management

Payments audits detect and correct financial vulnerabilities that could negatively affect an MSP.

Audits can detect overcharging, underpayment, or unauthorized payments by thoroughly reviewing financial transactions and billing records.

For example, if you accidentally overcharge a client for a service, the auditing process can detect this and allow an MSP to refund the client and maintain their trust.

Conversely, if you undercharge a client, you can spot this mistake and retroactively charge them or ensure you bill them for the appropriate amount moving forward.

Frequent audits also detect patterns of mistakes or fraud early on. This helps prevent relatively insignificant financial losses from becoming much more severe.

2. Regulatory Compliance & Data Security

Because so much client information is digitally stored, protecting it matters more than ever.

A payments audit can assess client data management and ensure your company follows the highest security standards in safeguarding client information.

Regular payment audits help ensure an MSP remains compliant with industry regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), SAQ-A, and any local or industry-specific regulations.

Depending on the regulations, non-compliance can lead to hefty penalties, legal battles, and even reputational damage.

For example, the PCI SSC can impose fines of up to $500,000 per violation of the PCI Data Security Standards.

An audit may discover that you do not process some payments according to the data security requirements set out in the PCI DSS.

Old encryption protocols or lax access credentials could be in place, which leaves client data more vulnerable to hackers or data breaches.

If a payments audit can preemptively catch these issues, it will save you significant time and money and keep you in good standing with regulatory bodies.

3. Financial Transparency

Trust with both clients and stakeholders is paramount for MSPs.

Should a client ever come to you with questions about their payments and the services you bill them for, knowing you have accurate financial records to show them is invaluable.

Transparency leads to positive reputations and strengthened client relationships, and clients can see you run your business with integrity.

For stakeholders, financial transparency is just as important.

A company that adheres to ethical financial standards and tracks its financial progress demonstrates to stakeholders its commitment to sound financial management.

This promotes confidence in the company’s stability and long-term sustainability.

4. Improved Decision-Making

Your decision-making is only as good as the data behind these decisions. If you collect inaccurate payment data or do not collect it at all, your business decisions will be flawed and misinformed.

Audits provide vital information about the MSP's financial standing. Without this information, making effective decisions about budgeting and allocating resources can prove challenging.

For example, if a payment audit finds that an MSP loses monthly revenue due to billing errors, it can decide how best to address this issue.

This might mean upgrading their billing software, outsourcing payment operations, or training their staff on billing best practices.

5. Error Reduction

According to data from a Gartner study, 18% of accountants admitted to making financial mistakes at least daily, and 59% reported making numerous errors each month.

If trained financial professionals make mistakes this often, MSPs who manage their own finances stand to make them at least as often.

The error rate could be even higher for those who use manual payment processes instead of payment automation.

Manual data entry can lead to many of these mistakes.

According to a DocuClipper report, manual data entry averages 96% to 99% accuracy.

On the other hand, automated data entry has an average accuracy rate of 99.959% to 99.99%.

As small as this difference might seem, it can significantly affect your billing accuracy and efficiency.

For example, with 10,000 data entries, automated systems might make just one to four mistakes, while manual data entry could make 100 to 400 mistakes.

Payments audits can catch these mistakes, allowing you to correct them, reduce your error rate, and improve your cash flow.

6. Optimized Cash Flow and Profitability

Your MSP relies on efficient cash flow to pay upfront costs to vendors and employees and keep your business running. Without adequate cash flow, you’ll struggle to meet your financial obligations.

Errors in your payment processes could significantly affect your cash flow and, in turn, your profitability.

Regular payment audits keep your payment process on track by identifying any payments that should have gone through but didn’t.

These could be:

- Late payments

- Unpaid invoices

- Subscription renewals that didn’t get processed correctly

For instance, a payments audit might reveal that a system glitch caused you to miss a customer’s recurring payment.

If the audit uncovers these issues, you can rectify them and collect all the revenue owed to you. This is imperative to meet running costs and earn a sufficient profit to invest in the growth of your MSP.

7. Asset Management

Proper asset management, including investments in technology and software, is essential to operational success. After all, these assets help you run your business and serve clients.

Audits help determine if assets are utilized efficiently and provide a good return on investment.

For example, an audit can show that you don’t use specific software licenses to their fullest extent. You can then redirect these resources more effectively.

This level of detail in accounting helps you maximize the return on your investments, maintain efficiency, and avoid unnecessary expenses.

{{ebook-cta}}

Step-by-Step Guide to Conducting Effective MSP Payments Audits

Having established the importance of conducting MSP payments audits, we will now proceed to the step-by-step process for performing the most comprehensive and valuable audits.

1. Pre-Audit Preparation

Pre-audit preparation sets you up for a more successful audit process that doesn’t skip any critical details.

To start, prepare and gather all the financial documents, records, and data related to payments, invoices, and transactions. The more information you have sorted and organized before the audit, the faster and more effective it will be.

Next, define the audit's scope.

For example, it could include examining:

- Accounts payable

- Accounts receivable

- Recurring billing

- Compliance with internal policies and external regulations

2. Selecting the Right Auditor

MSPs are unique business models. The ideal auditor must have a solid understanding of this, including challenges with recurring billing cycles and the requirements of PCI DSS.

Team members with a solid financial background and an understanding of the intricacies of the MSP payment process typically conduct internal audits.

Either way, whether you decide to perform an internal or external audit, your auditor must be objective, diligent, and willing to investigate payment issues, no matter how complex.

3. Conducting the Audit

Ensure all the payments to and from the MSP correspond to the services provided and that no payments have been made in error. In other words, verify the accuracy of all transactions.

To do so, confirm that:

- You have billed clients per the agreed-upon payment terms

- No unauthorized or erroneous charges

- Clients have not incurred charges without their consent

Make sure existing payment systems are effective, especially those involving manual data entry, which are prone to errors.

Check whether you comply with security standards and data-protection protocols for client information. Look for any vulnerabilities and what can be done to improve accuracy and security.

4. Review of Findings

A review of findings from the payments audit should detail what it uncovered.

The review should provide concrete examples (e.g., you’re billing some users twice a month) and suggestions for what to do about them.

Then, you can present these findings to your key stakeholders, who include your finance, ops, and management teams.

This review lets you determine the next best steps for implementing necessary payment changes.

5. Implementing Changes

The audit's recommendations are applied to improve financial operations and controls in the implementation phase.

These changes could include:

- Revamping the billing software to reduce the need for manual data entry

- Overhauling internal processes to improve oversight

- Implementing more robust security safeguards to prevent data breaches

Start with the most critical issues that could disrupt cash flow, compromise compliance, or undermine client trust.

Delegate who will do what to hold team members accountable for these changes.

If executed orderly, these changes will build a more stable financial operation.

6. Continuous Improvement

Involve any necessary staff members so they are trained and informed on best practices, including accounting or bookkeeping practices, regulatory compliance, and privacy/security.

Make it a point to conduct periodic training to keep all staffers current on best practices and regulatory changes.

Creating awareness of the power of payment audits can go a long way in instilling a culture of compliance.

When your staff understands the importance of the company’s financial integrity, they can take steps to ensure it.

7. Training and Awareness

Any team members involved in financial operations must be knowledgeable about proper record-keeping, compliance with regulations, and safeguarding clients’ information.

Brief them on the latest best practices and regulatory changes through regular training sessions.

Creating awareness about the value of payment audits encourages a culture of diligence and responsibility.

When people in the financial operations chain recognize their role in maintaining financial integrity, they are more likely to pay attention to details and follow proper procedures.

8. Monitoring and Regular Reviews

Implement systems for regular monitoring and periodic reviews to maintain improvements from an MSP payments audit.

For example, you might:

- Use automated alerts to flag large or unusual transactions.

- Schedule periodic mini-audits.

- Conduct periodic check-ins to discuss the effectiveness of internal controls.

These regular reviews allow you to revisit processes, adjust, and keep financial operations moving smoothly.

Ongoing monitoring helps you identify minor problems before they become big ones.

9. Leveraging Technology

Implementing best-in-class, automated MSP payment software allows for greater accuracy and efficiency when executing payment audits.

Automation is helpful for repetitive tasks that may otherwise be subject to human error, increasing the chances of mistakes or delays.

Your chosen payment software should be compatible with your existing systems and workflows to automate payments, minimize data-entry errors, and improve reporting accuracy.

For instance, an automated billing system increases the likelihood of recurring payments running smoothly and on time, reducing the risk of revenue leakage.

With recurring billing, payment information only has to be entered once, which means there are fewer opportunities to input data incorrectly.

Provided you conduct routine payments audits, you can quickly address errors in automated payments.

10. Feedback and Adjustment

Invite feedback from all stakeholders involved in the audit process, including the auditors, the staff, and the clients.

Inquire about what worked well and what should change – both how an audit was conducted and how and whether the changes were implemented.

Use the feedback to inform future audits and MSP financial management practices.

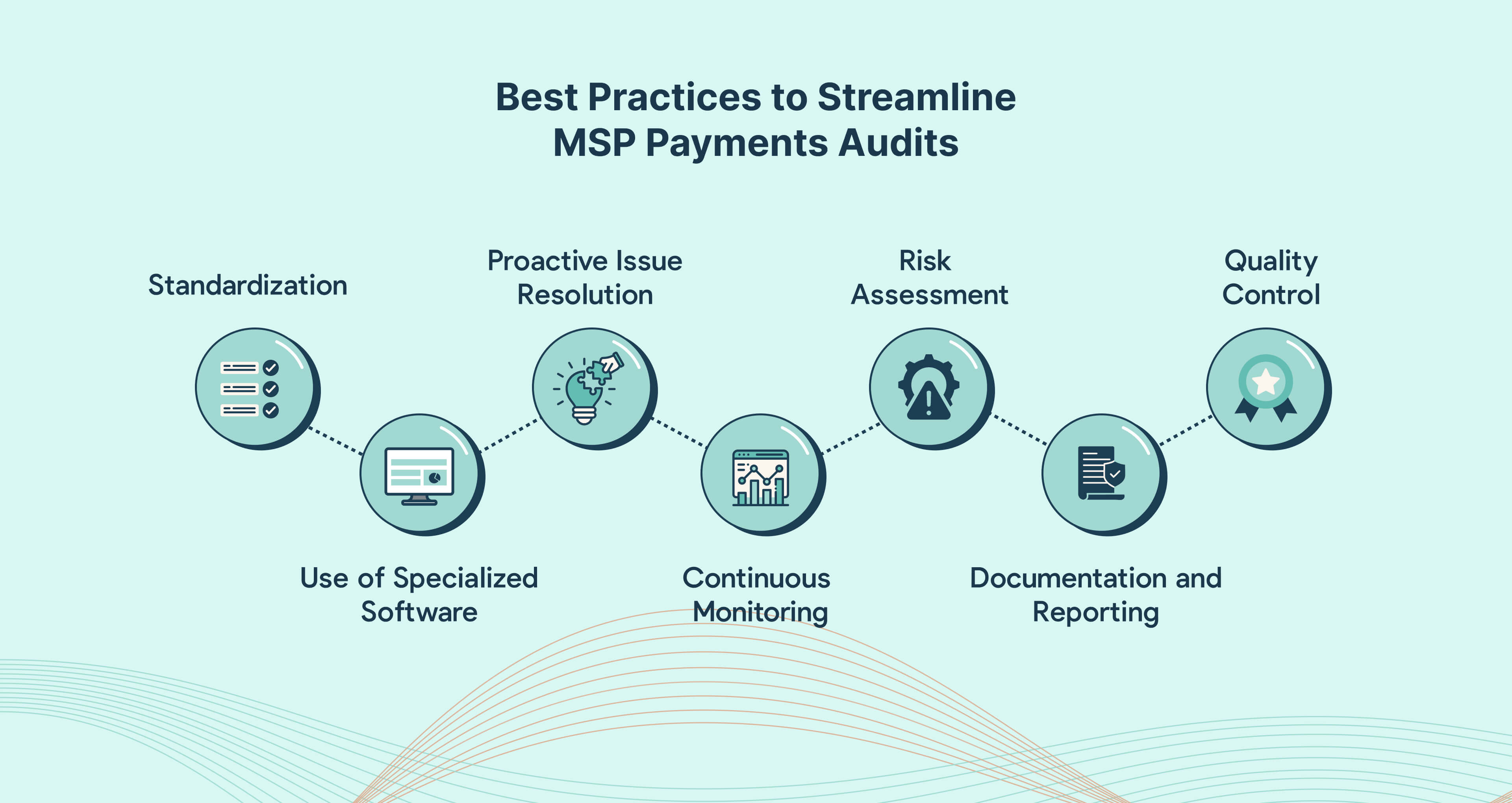

Best Practices for Streamlining MSP Payments Audits

Next, we will discuss helpful best practices to streamline MSP payments audits and make the undertaking less daunting.

According to eMarketer research, the B2B segment is the largest in overall US payment volume. Small and medium-sized businesses account for 44.9% of B2B transaction value.

These values demonstrate the sheer volume of transactions an MSP must handle, emphasizing the importance of performing payments audits.

Properly executed audits help you ensure financial accuracy, avoid mistakes, and prevent non-compliance.

Here’s how MSPs can conduct payments audits more efficiently:

1. Standardization

Implement and develop standardized auditing procedures across all departments.

Standardization clarifies each payment audit by providing a standardized framework for what will be audited, which areas need further attention, and how findings will be reported.

A standardized checklist ensures all accounts payable and receivable are examined systematically.

This consistency makes a more reliable auditing system, improving the likelihood of being followed and replicated.

2. Use of Specialized Software

MSP-specific payment automation software can centralize all your payment information in one place. Your software can track client invoices, payments, and subscriptions within one integrated platform.

This makes it much easier to refer to previous transactions and spot any problems and anomalies.

For example, if a client disputes a charge or you want to confirm a subscription payment was processed, you can do so in just a few clicks.

This centralized tracking benefits audit accuracy and helps you conduct audits faster. You don’t need to cross-check each system or search through the records.

Research shows that payment automation software helps companies reduce manual errors and quickly resolve payment discrepancies.

According to a study from PYMNTS and American Express, businesses that use manual payment processes take 30% longer to follow up on overdue payments than those using automated options.

With the right MSP payment automation software, you can track and monitor payments more easily and speed up the payment process thanks to automated vs. manual processes.

3. Proactive Issue Resolution

Promptly responding to vulnerabilities or mistakes uncovered in audits helps prevent problems from snowballing.

Effective and quick action can prevent cash flow and other problems when an audit identifies issues or irregularities.

For instance, your audit might reveal you have a high rate of outstanding invoices or particularly high days sales outstanding (DSO).

It could offer even more detailed information, including the percentage of outstanding invoices and how this changes monthly.

When you address these findings by implementing a robust process that streamlines the MPS payment process, the problem stops escalating, and your cash flow improves.

4. Continuous Monitoring

According to data in the 2024 AFP Payments Fraud and Control Survey Report, 80% of organizations fell victim to payment fraud attacks or attempts in 2023, a 15% increase from the previous year.

With a continuous payment monitoring tool, you can intervene immediately instead of when you perform a payments audit.

While a periodic audit may reveal issues that occurred a year or more ago, continuous monitoring provides ongoing oversight of financial transactions.

Then, you can identify issues or fraudulent activities as they occur and take a proactive rather than reactive approach.

For example, your payment automation software can notify you immediately if a payment fails. Then, you can contact the client to rectify the problem and collect the revenue.

5. Risk Assessment

Risk assessments allow you to schedule audits for the areas with the highest risk to your financial health.

For example, your recurring billing processes or vendor payments may need closer scrutiny.

Or, if the risk of revenue leakage in high-volume transactions is high, more scrutiny could be placed on those.

Risk assessments can also identify emerging threats, such as a new form of payment fraud or an upcoming change in regulatory requirements that could affect how a specific financial process is carried out.

6. Quality Control

Strong quality-control measures help you perform the audit process correctly.

Quality control might involve peers reviewing payment audit findings, ensuring there are no anomalies in the data used for the audits, and periodic reviews of the process itself.

For example, having a second auditor review the audit work performed by the first auditor can ensure the audit results are accurate and complete.

In addition to peer reviews, a good quality-control process includes regularly checking that data matches between internal records and external statements.

If the numbers don’t match, an investigation is warranted to understand why.

Periodic reviews of quality-control procedures also ensure they remain effective and aligned with industry standards.

7. Documentation and Reporting

Proper documentation and reporting support the audit process.

They provide valuable information for:

- Historical record-keeping

- Tracking changes over time

- Providing evidence of MSP compliance with the PCI Security Standards Council

Documentation of a payments audit, including all findings and corrective actions taken, can be used to support regulatory reviews or audits in the future.

Conclusion: Enhancing Compliance and Efficiency Through Regular Payments Audits

MSP payment audits are a valuable tool for ensuring your long-term financial success.

With well-documented audit processes and findings, you can act proactively rather than reactively to payment issues, including inaccurate amounts or payment schedules.

Following the best practices outlined in this article helps MSPs better manage the payments audit process, reduce risks, and improve cash flow.

These practices make the payment audit more effective and contribute to an MSP's growth and sustainability.

Payment automation software built specifically for managed services providers is a powerful asset to any MSP.

With it, you maintain compliance and payment efficiency and mitigate the risks of revenue leakage and not complying with regulatory standards.

FlexPoint payment automation software eliminates manual payment and billing processes, streamlining both. This reduces the risk of errors and speeds up payment cycles.

With features like automatic payment reconciliation between the tools you use, automated bank deposit reconciling, and easy access to the details of payment options, the accounts payable process is sped up significantly.

TekRESCUE, a Texas-based MSP, approached FlexPoint to streamline its payment processes.

The initial payment audits uncovered pressing issues, including their existing ticketing system's lack of detailed descriptions for each invoice.

Before switching to FlexPoint, tekRESCUE was also relying on manual-entry spreadsheets to track:

- Recurring monthly and annual payments

- Automatic payments

- Paused clients

- Payment methods

After making the switch, tekRESCUE saw a 75% improvement in accounting efficiency and a savings of 20 hours per month in time spent on accounts payable tasks.

Now, tekRESCUE’s invoices go out on time and include status updates. The FlexPoint system notifies tekRESCUE if payments or messages bounce so they can take timely action.

To experience similar results for your MSP, streamline your MSP payment processes and ensure financial integrity with FlexPoint.

Visit our website or contact us today to learn more about our payments auditing tools and how they can help you maintain compliance and efficiency.

Additional FAQs: Payments Audit in MSPs

{{faq-section}}

.avif)