How AI Transforms Payment Processing for Managed Service Providers

According to Precedence Research, the U.S. B2B payments transaction market size is anticipated to grow at a CAGR of 9.95% to reach $1,080 billion by 2033 from $410 billion in 2023.

Digitization and automation of business payments are driving the growth. However, several companies use legacy payment systems, paper-based methods, and manual processes due to cost or complexity, which leads to payment delays, errors, and high transaction fees.

Artificial Intelligence (AI) is streamlining B2B payment processes by improving their speed, security, and efficiency while limiting costs.

From invoicing to payment management, AI's ability to analyze data and provide insights can potentially improve a business’s financial performance. For MSPs, that means handling a high volume of recurring transactions with greater accuracy and without service interruptions.

According to Mordor Intelligence, AI in the Fintech market is expected to grow at a CAGR of 23.82%, reaching an estimated $43.04 billion by 2029 from $14.79 billion in 2024. This growth shows the rising impact of AI for faster and safer payment processing.

AI uses machine learning (ML) and natural language processing (NLP) algorithms to manage tasks like invoice generation, data entry, and payment reconciliation.

It reduces the need for human intervention, cutting errors and payment delays while boosting efficiency. Predictive analytics can further help MSPs anticipate financial trends and optimize cash flow.

This article will explain how AI can revolutionize MSP payment systems. We will explore AI's current applications and potential role in MSP payment processing.

{{toc}}

The Role of AI in Modernizing MSP Payment Systems

AI and ML technologies provide MSPs with a more reliable payment processing method. Unlike manual processes, these technologies boost efficiency, reduce errors, and improve security, delivering a seamless experience for MSPs and their clients.

AI can handle large volumes of data quickly and accurately to analyze real-time transaction patterns. It can also more accurately identify and flag suspicious transactions than traditional methods to reduce payment fraud.

For instance, J.P. Morgan’s Safetech Fraud Tools® uses AI and ML to reduce false positives on online bookings using credit cards. The tool reduces chargeback rates to 0.05% for their clients.

MSPs receiving large volumes of recurring payments through credit cards can benefit from better fraud detection and fewer chargebacks. This can save costs and prevent reputational damage.

Here is how AI can help modernize MSP payment systems:

1. Automation of Routine Tasks

AI significantly enhances the automation of routine tasks in MSP payment systems, like invoice generation, data entry, and payment reconciliation.

ML algorithms refer to and learn from historical data to predict patterns in recurring MSP payments, leading to increased operational efficiency and timely payments.

With AI handling routine tasks and identifying potential payment fraud, MSPs have more bandwidth to focus on improving their client experience. This could include offering personalized services, providing faster response times, or even integrating chatbots for quick query resolution.

2. Fraud Detection

According to PYMNTS, eliminating checks can reduce 60% of payment fraud. Unlike paper-based and legacy payment methods, AI can analyze vast amounts of transaction data in real-time. It can detect fraudulent activities by identifying patterns or anomalies in data.

AI systems can flag suspicious transactions more accurately than traditional methods, reducing the risk of unauthorized payments.

AI can also help minimize chargebacks for MSPs. It is important as high chargeback rates can lead to high interchange fees because your transactions will be classified as high-risk payments.

According to The Payments Association, 75% of chargebacks occur accidentally, and 34% result from clients mistakenly identifying transactions as fraudulent. AI tools can mitigate this financial risk and improve compliance with industry standards.

3. Enhanced Customer Experience

AI and natural language processing (NLP) can enable MSPs to enhance their client experience through personalized and timely communication. AI can also personalize communication by analyzing past interactions and providing relevant recommendations.

AI tools, like chatbots and virtual assistants, can also help automate customer service tasks.

These can handle customer inquiries and provide instant responses. NLP can further assist customer support teams in understanding customer sentiment and resolving issues efficiently.

For example, IBM Watson Assistant uses LLMs to help companies deliver superior customer service by integrating with existing support systems. It also provides tailored responses based on customer history and preferences.

4. Predictive Analytics

AI’s predictive analytics can forecast future financial trends, cash flow, and client payment behaviors.

MSPs can use these insights to optimize payment schedules, anticipate late payments, and make data-driven financial decisions.

Predictive analytics analyzes past transaction data and customer behavior to identify patterns. MSPs can use it to proactively address potential issues, offer the client’s preferred payment methods, and inform their pricing decisions.

For instance, Anodot uses AI to enable companies to identify anomalies in payment patterns and proactively address potential issues before they escalate. It provides full context for detected anomalies, grouping related incidents, and identifying contributing factors.

5. Regulatory Compliance

MSPs must comply with financial regulations such as PCI-DSS to reduce the risk of hefty monthly penalties ranging from $5,000 to $100,000.

AI can automate compliance checks by ensuring all transactions adhere to legal requirements.

AI can also analyze irregular transactions against a vast database of regulatory requirements and risk indicators. It can automate compliance reporting by generating up-to-date regulatory reports and reducing the need for manual payment audits.

For instance, ComplyAdvantage uses AI to monitor payment transactions and ensure compliance with financial regulations. It reduces the burden of manual audits and ensures adherence to industry standards.

6. Cost Reduction

Implementing AI in payment processing significantly reduces MSPs' costs associated with invoicing, data entry, reconciliations, and payment audits.

According to Adobe, invoice processing costs range from $15 to $40 per invoice. Manual invoicing consumes time and resources, and MSPs may spend more time making invoice corrections due to human errors.

Additionally, AI can help identify potential fraudulent activities and prevent financial losses associated with chargebacks and disputes. It can help money in the long run by preventing damaged reputation and high interchange rates due to high-risk transactions.

For example, SS&C Blue Prism automates complex payment processes using AI-driven tools and improves overall efficiency by cutting down manual effort.

7. Decision Support

Real-time insights enhance MSP decision-making. AI tools provide accurate data instantly and reduce the time spent on manual analysis. They can help MSPs better understand client needs and behaviors, allowing them to tailor payment methods and processes accordingly.

AI-driven decision support systems can help MSPs optimize payment strategies, improve forecasting accuracy, and identify growth opportunities.

Making decisions based on actionable insights derived from transaction data analysis allows MSPs to set themselves apart from competitors. It helps improve customer satisfaction scores and retention rates.

For instance, Zoho Books offers AI-powered insights into recurring payment cycles. These insights help make data-driven decisions about when to send invoices, what payment methods to offer, and when to initiate follow-up on late payments.

8. Integration with Existing Systems

AI tools can integrate with existing MSP payment systems without requiring extensive overhauls. These integrations enhance the functionality of existing platforms by adding automation, analytics, and security features.

Some AI solutions can augment traditional systems and even learn from user behavior to improve accuracy and efficiency over time. They can save time for MSPs and also reduce the likelihood of human error in payment collection and reconciliation.

For instance, MuleSoft provides AI-driven integration solutions that connect disparate systems.

{{ebook-cta}}

9 Benefits of AI-Driven Payment Systems for MSPs

AI-driven payment systems reduce the time and effort required for payment collection and reconciliation.

According to UpLead, AI payment systems reduce manual labor by 70% and speed up payments by 46%.

MSPs can maintain their cash flow and improve financial operations with timely payments. You can use the time to provide better services to clients.

AI tools can enhance the accuracy of invoicing and reconciliations by identifying and correcting errors and saving MSPs from manually searching spreadsheets and invoices for issues.

With increasing cyber threats, security is a top concern for MSPs. AI-driven payment systems offer enhanced security to protect sensitive client information.

1. Speed and Efficiency

According to PYMNTS, 98% of businesses agree that automating payment processing speeds up the process and fuels their growth.

AI-powered systems process payments quickly and with fewer errors, reducing downtime and boosting efficiency. They streamline the payment process, speeding up cash flow and reducing bottlenecks. AI can minimize downtime and improve throughput by automating invoicing, reconciliation, and payment approvals.

MSPs can manage more transactions without human intervention and speed up payment cycles.

For instance, California-based Compunet Technologies reduced their monthly billing time from 5 hours to 15 minutes with FlexPoint’s automated billing feature. The AutoPay option helped improve their cash flow with 4x faster payment cycles.

2. Cost Efficiency

AI can lower overhead expenses and limit operational costs by automating invoice generation, data entry, transaction matching, fraud detection, reconciliation, and other aspects of the payment process. Traditionally, these tasks require extensive human resources.

Automation eliminates the need for large administrative teams and cuts down on labor costs.

According to Finextra, 44% of firms anticipate automation will result in cost savings and enhanced cash flow.

Moreover, reducing payment errors lowers the costs associated with rectifying invoicing and fixing financial discrepancies.

For instance, Loud & Clear, an Indiana-based MSP, saved thousands in fees with FlexPoint's Cash Flow Automation. The company reported 400% revenue growth in less than a year while spending five times less time chasing down payments.

3. Competitive Edge

According to McKinsey, data-driven companies that offer personalized customer experiences using AI are 1.7 times more likely to grow than those that do not.

MSPs implementing AI in their payment systems can offer services and payment processes personalized to suit client needs. Offering insights-driven customized payment plans and flexible payment options improves client retention and payment cycles.

Automation helps with timely invoice generation, payment tracking, and reconciliation. It ensures client services are not interrupted by payment complications.

MSPs can also identify and address financial discrepancies well in time to prevent losses due to incorrect billing.

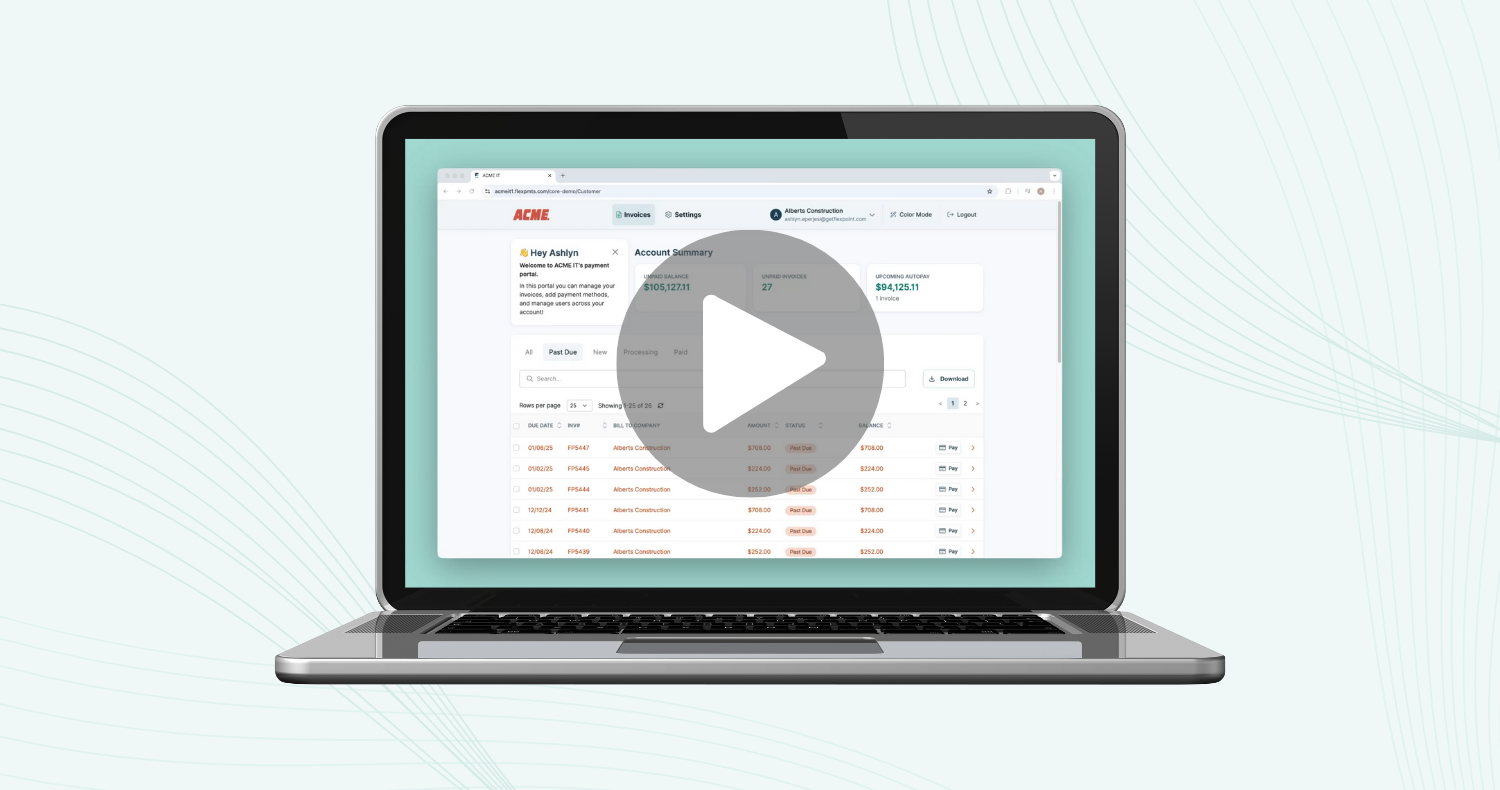

Ohio-based MSP SkyCamp Technologies improved its client experience with FlexPoint’s user-friendly portal. The self-service passwordless portal eliminated payment friction and allowed SkyCamp’s customers to view all payment details on a centralized platform.

Similarly, MSPs like yours can stand out and attract clients seeking modern, tech-driven solutions.

4. Improved Customer Relations

According to McKinsey, AI in customer service can deliver up to $1 trillion of additional value each year.

Automating payment processes using AI speeds up transactions, reduces wait times, and eliminates billing and reconciliation errors. Clients appreciate quick and error-free transactions, which reduces frustration due to delays and mistakes.

AI systems can help enhance customer satisfaction by offering tailored payment method recommendations and personalized payment portals. Your MSP team's ability to offer diverse payment options and real-time support enhances customer loyalty and satisfaction.

For example, TAZ Networks, an MSP from Metro Detroit, improved its clients' payment experience by switching to FlexPoint’s client portal. The easy-to-navigate portal allowed clients to view their invoice status, check outstanding payments, and raise concerns. The transparency and reliability provided by AI-driven systems build trust, encouraging ongoing business relationships.

5. Real-time Data Integration

According to Deloitte, US businesses are rapidly shifting to real-time payments, which could replace $18.9 trillion in ACH and check-based B2B payments by 2028.

MSPs need to keep up with this shift to remain competitive, and real-time data processing plays a crucial role in achieving this.

By integrating payment systems with popular accounting tools like QuickBooks Desktop, QuickBooks Online, and Xero, MSPs can enable two-way data syncs, ensuring that all payment information is automatically updated and accurate. This reduces manual errors, speeds up payment settlements, and helps MSPs get paid faster.

Real-time payment reconciliation further enhances this process, eliminating unnecessary payment follow-ups and keeping financial records current.

With AI-driven automation, MSPs can reconcile accounts as transactions occur, allowing them to make timely, data-driven decisions that improve cash flow and operational efficiency.

6. Advanced Fraud Prevention

According to the 2024 AFP® Payments Fraud and Control Survey Report, 80% of companies were payment fraud victims in 2023, and 30% of them could not recover lost funds.

MSPs must prepare to combat the increasing fraudulent activity with the rise of digital payments and online transactions.

AI payment systems use machine learning to accurately identify suspicious patterns and detect fraudulent transactions according to industry standards. The model improves over time as these systems continuously learn from transaction data and stay updated with regulatory changes.

AI-driven payment systems offer robust protection against financial losses by promptly detecting security threats. MSPs benefit from reduced financial risk and automated compliance with PCI-DSS norms.

7. Scalability

MSPs deal with recurring payments from multiple clients, and AI systems can easily handle these increased transaction volumes.

According to Nasdaq, adopting automation reduces paper invoice volumes and reduces manual errors, allowing companies to handle payments at scale.

AI systems can grow with your MSP and efficiently manage increased workloads without compromising accuracy or speed. By learning from previous systems, they improve performance as transaction volumes increase.

For instance, tekRESCUE adopted FlexPoint’s automated payment solutions to streamline operations as they scaled. It increased the MSP’s accounting efficiency by 75% and saved 20 hours per month spent earlier on invoicing and payment management.

8. Regulatory Compliance and Monitoring

MSPs must ensure that payment systems adhere to financial regulations such as PCI DSS and ISO standards to keep client data secure.

According to Thomson Reuters, AI can monitor regulatory obligations and track real-time changes to help companies stay compliant.

Manually reviewing changes in regulations and ensuring compliance is error-prone. AI can speed up the review and implementation of regulations to prevent fines.

AI adapts the systems to industry regulations to protect MSPs from the costly repercussions of regulatory breaches. As discussed earlier, Non-compliance penalties include fines from $5,000 to $100,000 per month and legal expenses.

9. Personalized Payment Experiences

A bad payment experience can turn off clients and impact the bottom line of your MSP.

According to PYMNTS, personalization can help B2B firms predict future payments and offer tailored recommendations. AI analyzes customer data to provide customized payment methods and schedules for client needs.

Personalized payment experiences make payments more convenient for clients, as MSPs have recurring payment cycles.

AI can enable you to offer discounts by tracking early payments, concessions on low-fee payment methods, or flexible payment schedules to make the payment process more appealing to clients. Thus, it can boost customer satisfaction and encourage higher engagement.

Conclusion: FlexPoint as Your MSP Payment Automation Solution

AI has a transformative impact on MSP payment systems, empowering clients to manage their invoices, track payments, and raise concerns seamlessly.

MSPs should consider AI tools for real-time data processing, efficient settlements, and fraudulent transaction prevention. Advanced fraud prevention measures, powered by machine learning, enhance security by proactively detecting suspicious activities.

An excellent payment experience improves customer loyalty and the operational efficiency of your MSP.

Using FlexPoint as your MSP payment automation solution helps you provide personalized and convenient payment experiences for your clients. FlexPoint also offers a competitive edge in the market by optimizing your MSP's revenue stream.

By integrating FlexPoint into your financial operations, you can ensure:

- Safer transaction handling

- Quicker payments

- Improved financial accuracy

- Tailor payment options to client preferences

FlexPoint’s passwordless client portal provides a user-friendly interface that can be customized to meet your client’s unique requirements. Adopting FlexPoint simplifies financial management and improves the efficiency of your MSP.

Enhance your MSP's payment operations with FlexPoint, the leading payment automation solution.

Prepare your business for the future by adopting FlexPoint today, and stay tuned as we introduce innovative AI features soon.

Visit our website or contact us to learn more about how FlexPoint can streamline your payment processes.

Additional FAQs: AI in MSP Payment Systems

{{faq-section}}

.jpg)

.avif)