Streamline MSP Payment Operations: Accounting Software Integration for Enhanced Efficiency

According to the Association of Chartered Certified System Accountants (ACCSA), around 21% of SMBs in the US have integrated their accounting software with payment and invoicing solutions.

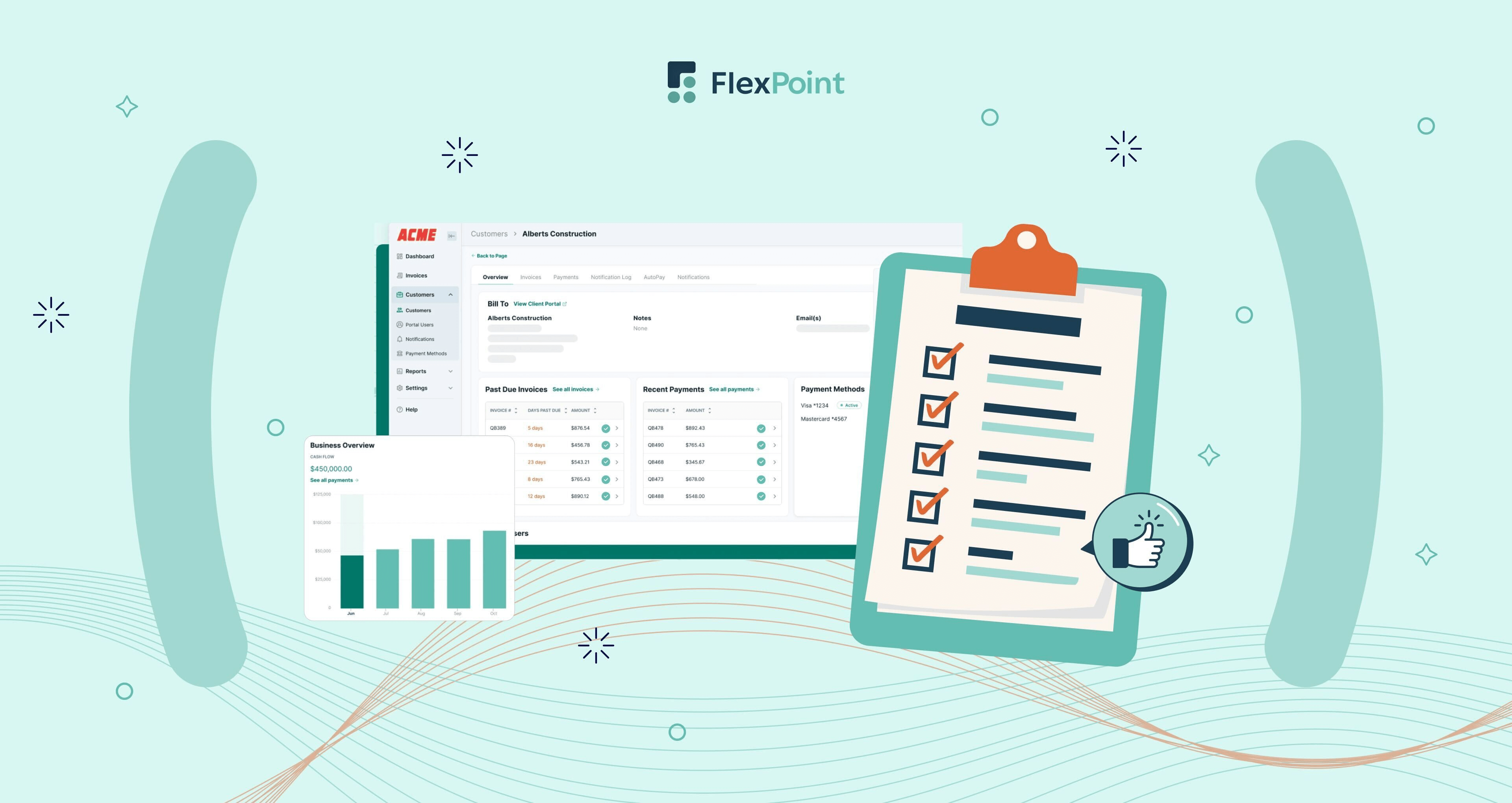

MSPs are not different. By integrating accounting software, MSPs like you can dramatically reduce manual billing workloads, enhance payment accuracy, and gain powerful insights into your financial health. This direct integration streamlines financial operations, allowing you to operate more efficiently and make informed decisions.

This article will explain the advantages of integrating accounting and payment software and outline strategies for effective integration implementation.

Finally, we will discuss how choosing the right payment platform can significantly enhance your business's efficiency.

{{toc}}

Key Advantages of MSP Payment and Accounting Software Integration

Integrating payment and accounting software has many benefits, such as improved operational efficiency, billing accuracy, and reduction in manual labor.

This section will discuss the main advantages of integrating payment and accounting software.

1. Seamless Workflow

Integrating your accounting and MSP payment software creates a seamless workflow by automatically syncing data between multiple business systems.

This integration reduces manual data entry on multiple platforms, minimizes human errors, and provides real-time financial insights.

With synchronized data, you can easily manage your billing workflow and ensure that all your financial records are up-to-date.

It also helps you manage your finances efficiently by offering a complete view of your cash flow. This allows you to spot trends, identify potential issues, and more accurately forecast your MSP's future financial needs.

For example, Skycamp, an Ohio-based MSP, switched from using multiple payment processors to a centralized billing system by integrating its accounting system, Quickbooks and its payments platform, FlexPoint. As a result, its team saved 8 hours of work per month.

More so, It is not uncommon for MSPs to spend hours, and sometimes days, ensuring data accuracy across all platforms. By inadequately integrating your payment system with accounting software, your MSP can save valuable time.

2. Improved Reconciliation

Payment reconciliation involves checking that the amounts received match those invoiced or recorded in your accounting system. This process is critical to keeping financial records accurate, avoiding errors, and ensuring all transactions are correctly tracked.

You can centrally manage invoices, payments, and customer details by properly integrating your payment and accounting software. This process reduces manual work and minimizes errors found in traditional systems.

To consistently ensure this, you need an automated payment reconciliation system that compares and verifies your internal financial records.

For example, IT Vortex, an NJ-based MSP, often needed help reconciling inefficiencies in manual invoicing and payment processes.

Customers had to leave the company's website to pay via PayPal, incurring extra fees. Attempts to streamline with Intuit were too costly and had a strict credit card approval process.

By adopting payment reconciliation software, IT Vortex automated deposit and transaction reconciliation. As a result, their financial team now saves 5 hours per month on these tasks.

It is not uncommon for MSPs to spend hours – even days – ensuring that data is up-to-date on all platforms. Your MSP can ensure proper reconciliation by integrating your payment system with accounting software.

3. Reducing Manual Work

A LogicMonitor survey found that nearly all MSPs (95%) believe automating processes is crucial for focusing on innovation and strategic goals.

The survey highlights benefits like better time efficiency (42%), fewer errors (34%), and increased profits (33%). These findings show the growing importance of automation in the MSP industry to boost efficiency and productivity.

Let’s take the example of SkyCamp Technologies, a Columbus, Ohio-based MSP that struggled with multiple billing platforms. Their ACH service wasn’t suited for small businesses, and QuickBooks ACH didn’t fully integrate with their invoicing system.

Dan Illausky, President of SkyCamp Technologies, said the lack of integration caused him to manually handle each monthly ACH payment, which could have been faster and more efficient. SkyCamp needed a complete overhaul of its billing operations.

After integrating their payment platform (FlexPoint) and accounting software (Quickbooks), he and his accountant saved 8 hours of manual work every month.

Instead of manually sending invoices to your MSP clients, which can take several hours dedicated to other productive tasks, you can integrate your accounting and payment software to do this repetitive task more effectively and save time.

4. Enhanced Compliance and Security

According to the IBM Data Breach Report, the average data breach in the U.S. costs $9.4 million. You can avoid or minimize these costs by ensuring PCI DSS compliance and other security practices in your payments and billing processes.

Robust payment software encrypts all client and financial data so only certain people can read it, and access controls ensure that only approved employees can see financial data.

Integrating accounting software like QuickBooks and Xero with secure payment software enhances compliance and security by:

- Consistent Data: It guarantees accurate and uniform financial records, minimizing errors and discrepancies.

- Automated Tracking: You can streamline tracking and reporting for audits and compliance checks.

- Enhanced Security: It helps secure payment processing, and encryption is used to safeguard sensitive financial data.

- Access Controls: You can regulate user permissions to prevent unauthorized changes or access.

- Regulatory Compliance: It aids in adherence to financial regulations, such as PCI-DSS.

Complying with these much-needed security rules also helps maintain your MSP's reputation in the marketplace. Clients who trust that you protect their sensitive data will feel more confident doing business with you.

5. Improved Financial Insights

A report by Pymnts shows that companies automating more than 50% of their accounts receivable see significant improvements. They report a 32% reduction in Days Sales Outstanding (DSO), cutting it down by 19 days.

Integrating accounting and payment software provides a comprehensive and real-time view of your financial health, including cash flow and profitability analysis.

This integration offers:

- Real-Time Updates: Automatically sync transactions to keep your financial information current, as discussed above.

- Unified Data: Combines payment and accounting data for a complete view of your finances.

- Instant Insights: Gives you quick access to your financial reports and payment/billing analytics.

This complete and current financial view aids in accurate forecasting and preparing for future trends. It lets you estimate upcoming expenses and potential revenue, better plan your growth, and minimize monetary risks.

6. Better Client Experience

Providing your clients with a great experience builds satisfaction and loyalty.

Automated invoicing ensures accurate and timely bills, reduces mistakes, and builds trust.

WJP Technology Consultants, a Texas-based MSP, improved its accounting by integrating QuickBooks with their billing platform FlexPoint.

This integration simplified payments, allowed clients to store their payment methods, and allowed them to set payment dates effortlessly.

Integrated systems also enable autopay through FlexPoint’s custom-branded client portal. This allows WJP's clients to set up an account, add a payment method, and use AutoPay seamlessly after their first invoice.

A smooth experience increases client loyalty and recommendations. Satisfied customers are more likely to recommend your services and efficiently manage their billing and payments.

{{ebook-cta}}

How to Implement MSP Payment Integration with Accounting Software

In the previous section, we have discussed all the key benefits of integrating your MSP accounting software with your billing & payment tool.

In this section, we will discuss the critical steps for effective implementation.

Here's how to effectively integrate MSP payment systems with accounting software:

1. Assessment

An excellent way to start your assessment is to evaluate your current financial workflows and understand your biggest problem.

Begin by thoroughly reviewing your existing processes, including how invoices are generated, payments are processed, and transactions are reconciled.

You can identify inefficiencies in this process, such as manual data entry, delays in payment processing, and error-prone reconciliation methods.

For example, analyze the time spent on manual tasks like attaching invoices and chasing payments and note any common errors like:

- Incorrect Invoice Details: Errors in your client information, service descriptions, or amounts.

- Duplicate Invoices: Sending the same invoice more than once.

- Payment Misapplication: Applying payments to the wrong invoices or accounts.

- Missing Invoice Follow-Ups: Failing to follow up on overdue invoices promptly.

- Delayed Invoicing: Not sending invoices on time affects your cash flow.

- Inconsistent Records: Discrepancies between invoicing records and accounting systems must be addressed.

2. Select Compatible Software

You need payment software that works smoothly with your accounting software without much customization.

Selecting payment software that integrates smoothly with widely used accounting tools like QuickBooks or Xero will save you and your team from the hassle of manual code customization, which can lead to problems if done incorrectly. Plus, you don’t have to possibly hire a developer to help set up the integration, which can add up to be an extra expense.

A robust MSP-payment platform like FlexPoint directly integrates with QuickBooks Online and QuickBooks Desktop, which many MSPs use.

FlexPoint's integration capabilities allow it to automatically sync payment data with QuickBooks, ensuring that all transactions are accurately recorded and reconciled without manual intervention.

3. Test and Optimize

Start by running initial tests to verify that payment data syncs accurately between systems.

For example, process test transactions using your payment platform and confirm they are correctly recorded in your accounting tool.

Perform tests, including checking complete transactions, handling errors, and verifying data accuracy to identify issues.

Optimize the system by adjusting update frequencies, user permissions, and security protocols to balance performance and data accuracy.

Thorough testing and optimization ensure a seamless, accurate, and efficient workflow, minimizing disruptions and maximizing the benefits of your integrated system.

For example, send out a test invoice to your team for a small amount and see that all the data sync works fine.

4. Training and Support

Use the support resources offered by the software vendor, such as tutorials and a knowledge base. These can help solve any problems during onboarding or setup.

An onboarding specialist from the software company can also help your team quickly get used to the new system. Hence, choosing a vendor who can help you and your team get up to speed with the latest software integration is essential.

Ensure that all your financial staff is trained on the new processes, using the vendor's support for thorough training to help them feel confident.

Conclusion: Streamline MSP Payment Management with FlexPoint

In this article, we've discussed the benefits of integrating payment and accounting software, such as streamlining financial operations, reducing manual workloads, and providing real-time financial insights, along with steps for implementation.

However, once MSPs understand the significance of this integration, the problem is finding a viable, robust payment system that fits this purpose.

That’s where FlexPoint comes in as a proven choice based on the experience of hundreds of MSPs nationwide.

FlexPoint's powerful accounting integration capabilities are tailored specifically for MSPs.

By seamlessly integrating with leading accounting tools like QuickBooks and Xero, FlexPoint enhances payment accuracy, provides real-time financial insights, and ensures automated payment reconciliation.

For MSPs looking to streamline financial operations, FlexPoint is the best option. Its proven automated reconciliation, secure data handling, and comprehensive support ensure smooth and efficient business operations.

Ready to revolutionize your MSP payments? Discover how FlexPoint can elevate your service delivery and financial management.

Visit us or book a demo today to see firsthand how FlexPoint can transform your MSP payment operations.

Additional FAQs: MSP Payment and Accounting Software Integration

{{faq-section}}

.avif)